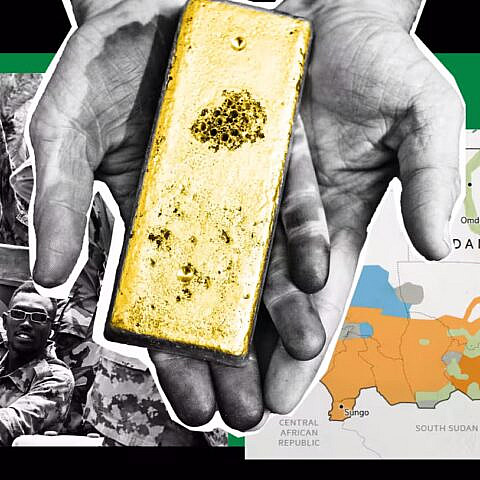

Bullion for Bullets

As conflict rages in Sudan, new C4ADS analysis shows that the Sudan Armed Forces and Rapid Support Forces alike are funding their operations with revenue derived from gold and mineral production — and maps a new network of entities that remain wholly untouched by current sanctions.

Executive Summary #

On April 15, 2025, the armed conflict in Sudan entered its third year. The war—waged by the Sudanese Armed Forces (SAF), which seized control of the government in October 2021, and the paramilitary Rapid Support Forces (RSF)—has exacted a heavy toll on civilians, as it has brought widespread famine, displacement, and death. In addition, the U.S. government has renewed accusations of ethnic cleansing in Darfur, declaring that the RSF and allied militias have committed genocide in the region. With no clear signs of a resolution or military victory in sight, it is critical to expose and disrupt the funding mechanisms of the

warring parties.

Minerals, historically a crucial funding source for the SAF and RSF, are a growing but underaddressed pressure point. Enforcement agents investigating these funding sources have largely focused on disrupting gold revenue from the point of export onward, including revenue from the refinement of Sudanese gold in countries like the United Arab Emirates (U.A.E.). Recent sanctions reflect this focus: in January 2025, the U.S. sanctioned U.A.E.- based gold purchaser Al Zumoroud and Al Yaqoot Gold & Jewellers L.L.C. and its manager. However, both the SAF and the RSF profit from unrestricted funding streams provided by the mining industry, both by controlling mines and collecting taxes, with the de facto Sudanese government’s pre-export gold flow revenue reportedly reaching US$1.6 billion in 2024 alone.

To more comprehensively understand how the SAF and RSF profit from minerals, we used trade data, corporate records, satellite imagery, and other types of publicly available information to analyze Sudanese warring parties’ control over pre-export steps in gold and non-gold mineral supply chains. This analysis backs recommendations for trade- and revenue-focused action against sanctioned drivers of violence in Sudan. Specifically, it proposes increased focus on the following:

- Mining entities. According to satellite imagery analysis, concessionary mining is still operational in Darfur, the Red Sea State, the River Nile State, and the Northern State. While sanctions in several jurisdictions have targeted a number of SAF- and RSF-associated companies, including the RSF-associated mining entity Al Junaid, many other concessionary mining entities that are linked to the warring parties by corporate ties remain unsanctioned. Extending sanctions to cover this gap—including to the companies operating the mines and key upstream facilitators, like Sudamin Company Ltd—could help stifle revenue streams for warring parties.

- Precursor chemical imports. Precursor chemicals are essential to the mining process. It is crucial to target actors who supply the necessary materials for the gold and mineral production from which the warring parties profit. Trade records indicate that Chinese entities such as Shandong Smart International Logistics and JYT (Qingdao) Logistics Co, Ltd. have shipped more than 2,800 drums of precursor chemical sodium cyanide to Sudanese state-owned enterprise Sudamin. Such conduct enables conflict financing for the SAF, but has thus far remained untargeted by enforcement efforts.

- Gold taxation. In 2020, the Sudanese Mineral Resources Company (SMRC), the regulatory authority for mining in Sudan, reported a total tax revenue from Sudan’s gold production of US$418 million, extracted from 35.7 metric tons of gold in recorded production. In 2024, this value increased to US$1.6 billion in government revenue. Export proceeds from nine months in 2024 reportedly reached US$1.18 billion, indicating that the US$1.6 billion brought in through the SMRC’s taxation is a significant, high-risk conflict financing node for SAF. The SMRC remains unsanctioned.

- The broader mineral sector. Trade data indicates that more than 70 cargoes of chrome ore, weighing more than 2 million kilograms (kg) total, have been shipped from Sudan to China since the start of the conflict. China is the world’s largest

chromium importer, with demand anticipated to continue to rise. Increasing Chinese demand for Sudanese chrome could result in chromium becoming a more stable form of revenue for the Sudanese government than gold. Alternate minerals present a means of funding diversification for the warring parties that is insulated from sanctions on conflict gold.

Enforcement agencies and policymakers have largely overlooked key pressure points in the mineral sector. By taking a more comprehensive approach to throttling RSF and SAF mineral revenue, enforcement agents can take decisive steps to curb actors responsible for atrocities.

In the News #