Due Diligence in Minerals Supply Chains

C4ADS analyzed the business activities of three gold trading companies active in Madre de Dios, a Peruvian region where unregulated gold mining has caused severe environmental damage, to better understand how high-risk gold from the region enters global markets and reaches end users. Nearly all of the gold exported by these companies since 2017 has been shipped to India and the United Arab Emirates, where most of it appears to be refined and traded as bullion or jewelry. A share of that gold, however, may still end up in the products of public US companies that source from a particular Indian refinery. These findings suggest that downstream companies must look beyond their immediate suppliers to gauge the full impact of their sourcing practices.

Gold Mining in Madre de Dios, Peru #

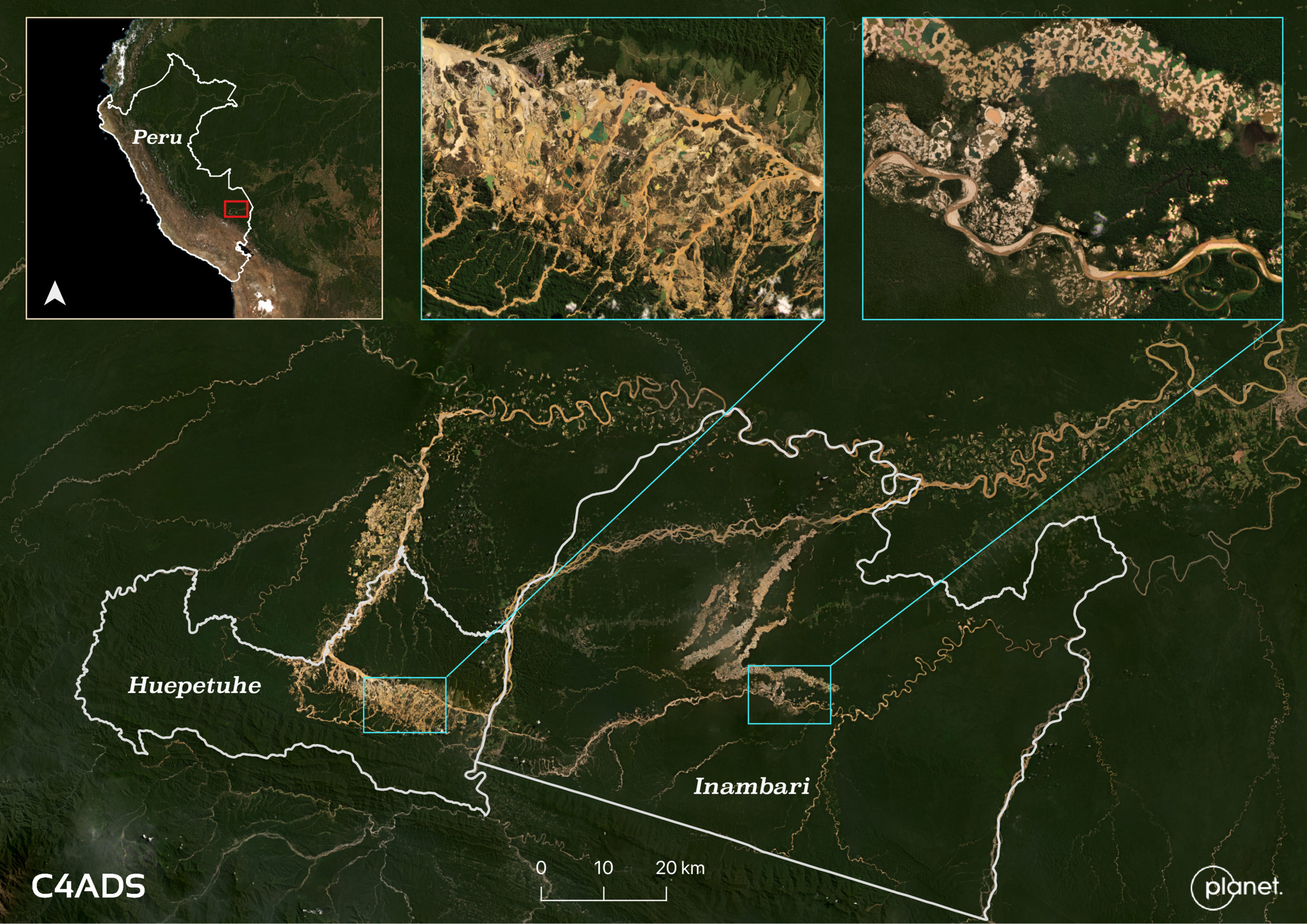

Illicit gold mining in the Amazon basin has driven deforestation, contaminated river systems with mercury, and undermined public security across the region. These negative consequences have been documented in Colombia, Ecuador, Brazil, Bolivia, Venezuela, and Guyana, but are nowhere more apparent than in Madre de Dios, a department in southeastern Peru bordering Brazil and Bolivia. The environmental harm caused by gold mining-linked deforestation in the Amazon represents a growing supply chain risk for downstream companies, alongside deforestation linked to oil, beef, soy, and other commodities.

In February 2019, the Peruvian government launched a large intervention against illegal mining in Madre de Dios. Since then, gold mining deforestation in the region has decreased by 78%, according to the Monitoring of the Andean Amazon Project (MAAP), a group that uses satellite data to monitor deforestation in the Amazon. Despite the operation’s early success, however, MAAP has documented the expansion of gold mining activity into primary rainforests and other sensitive areas.

US and European companies face growing pressure from governments to conduct rigorous supply chain due diligence and disclose sourcing practices, which requires a better understanding of whether the extraction of raw materials may be linked to conflict, environmental degradation, human rights abuses, or other problems. Concern over deforestation in the Amazon has mounted in the United States and European Union, where environmental sticking points have stalled negotiations with Brazil on environmental assistance and trade. For manufacturers, jewelers, and other downstream users of gold that wish to avoid sourcing conflict-affected or high-risk gold, gold sourced from Madre de Dios should be treated with extra scrutiny.

A Gold Trading Consortium in Madre de Dios #

In 2012, Peruvian state-run mining company Activos Mineros S.A.C. (AMSAC) granted private gold trading firm E&M Company S.A.C. special authorization to purchase and market gold from Madre de Dios. AMSAC extended the authorization for E&M in 2018 and added another company, Dana Gold S.A.C., which began operating together with E&M under the name Consorcio Gold Star.

A third private gold trading company, A&M Gold Metal Trading S.A.C., was registered at the Cusco address of Dana Gold in 2013. Although not listed as a Consorcio Gold Star company, A&M also shares several addresses for annex offices with the two Consorcio Gold Star companies, according to Peru’s corporate registry. These addresses appear to correspond to purchasing outposts where the companies may buy gold from local miners.

Soon after AMSAC granted E&M its purchasing authorization, the company was publicly linked to money laundering and illegal mining. Peruvian authorities began investigating E&M for money laundering in 2013 after Peruvian newspaper El Comercio reported that the company was a principal buyer from one of the region’s largest illegal gold mining operations. The same year, a manager of Dana Gold was detained in Jorge Chávez airport in Lima with $300,000 in undeclared cash. In 2014, Peruvian customs officials seized nearly ten kilograms of suspected illegal gold from E&M at a warehouse in the Port of Callao. In 2018, investigative outlet Ojo Público reported that E&M, along with two other AMSAC-authorized companies, was again under federal investigation for money laundering and tax evasion.

AMSAC terminated its commercialization agreement with Consorcio Gold Star in April 2019, but Consorcio Gold Star has continued exporting gold to overseas buyers.

Consorcio Gold Star’s Exports #

E&M Company has been shipping gold abroad since at least 2012, the first year for which data is available from Veritrade, a commercial trade data provider. The company shipped almost entirely to Metalor in Switzerland until 2014, when it began shipping to customers in the United States. Since 2017, however, almost all of E&M’s exports have been shipped to companies based in India and the United Arab Emirates.

At the same time that E&M began ramping up its exports to India and the United Arab Emirates, A&M Gold Metal Trading and Dana Gold also started sending gold to both countries—especially to India. Exports to India from E&M, A&M, and Dana Gold more than doubled from 753 kilograms in 2017 to nearly 1,700 kilograms in 2018. Between 2017 and 2020, the three companies sent a total of 5,283 kilograms to India; 1,272 kilograms to the United Arab Emirates; and 753 kilograms to the United States.

Kundan Care Products: The Top Importer #

C4ADS assessed the business activities and due diligence policies of Consorcio Gold Star’s top importer, Kundan Care Products Ltd. to see how gold from Madre de Dios enters the global market. Kundan Care Products is a subsidiary of Indian business conglomerate Kundan Group, which holds interests in energy, timber, petrochemicals, agricultural commodities, and precious metals. Kundan Group owns a precious metals refinery in the city of Haridwar, in North India’s Uttarakhand state, which maintains distribution offices across India and “representative offices” in nineteen foreign countries, according to its website.

Kundan Group’s precious metals refinery advertises a range of gold and silver products on its website, including coins, pendants, and bars. The refinery also markets a line of jewelry products under the brand name “Zeya.” Kundan sells its products through its retail locations and through dozens of independent jewelers across India. Both lines of products also appear available for purchase through Amazon and Indian e-commerce platform Flipkart.

Although not stated on its website, Kundan appears to act as an international supplier to manufacturers and other companies that use gold and other precious metals in their products. Minerals due diligence reports filed with the US Securities and Exchange Commission show that at least 40 publicly-listed US companies have sourced gold from Kundan since 2018, including General Electric, Halliburton, IMAX Corporation, and Stryker Corporation.

According to a 2015 Human Rights Watch (HRW) report on child labor in Ghana’s gold mines, Kundan was one of six international refineries sourcing gold from Ghana’s artisanal mines at the time of the report’s publication. HRW analyzed the due diligence policies and procedures of all six refineries, finding it impossible to assess Kundan’s policies and procedures due to a lack of available information such as sourcing guidelines, compliance policies, or summary audit reports. Although Kundan did not respond to the report’s authors to clarify its due diligence procedures, it has since added a “Policy & Compliance” page to its website, which states the following:

Tweet It“Kundan has always adopted certain principles to fulfill the International standards and Guidelines set up by OECD in terms of social, economical and environmental factor. Kundan follow the policy set up OECD for combating Money Laundering and the Financing of Terrorism by implementing internal measures as may be deemed necessary Certain Steps or training process has been conducted to prevent.”

No further information on the details of Kundan’s sourcing practices or due diligence procedures was available on the company’s website as of June 10, 2021. While the lack of detail in Kundan’s statement does not necessarily imply that the company lacks more robust internal guidelines, such limited transparency complicates efforts to gauge Kundan’s full scope of business activities.

Implications for Downstream Buyers #

Companies are under growing pressure from governments, investors, and consumers to ensure that their supply chains are free of exposure to deforestation, human rights abuses, and other risks. The growing complexity of supply chains for commodities such as gold, however, can make it difficult for downstream companies to determine the origin of materials sourced from intermediary suppliers.

C4ADS addresses this problem by integrating and analyzing publicly available information to shed light on the ownership and operations of companies across commodity supply chains. We use sources such as corporate records, media reporting, and satellite imagery to assess upstream conditions and risks; trade data from commercial providers to trace commodities from trading companies in source countries to intermediary companies in foreign jurisdictions; and transponder data to track maritime vessels and aircraft.

Although it is difficult to trace a single gold bar from its point of origin to the end user, integration and analysis of publicly available information can help elucidate this opaque corner of the global economy. Given Kundan’s historically weak due diligence policies and ongoing trade relationships with companies linked to mining deforestation, gold sourced from Kundan may represent a supply chain risk for downstream buyers.