A Hull in Their Story

In November 2019, at least two VLGCs (very large gas carriers, ships that carry between 50,000 and 80,000 cubic meters of gas) visited an export terminal in Asaluyeh, Iran, an industrial town on the southwestern coast of the country, to load up on liquified petroleum gas (LPG). Thanks to commercially available satellite imagery, automatic identification system (AIS) data, and other publicly available information, C4ADS can offer insights into this illicit trade, detail how it is conducted, and even identify some of the likely players involved.

A Hull in Their Story: Satellite imagery, AIS, and the Ships Secretly Transporting Iranian Gas to China

Evan Accardi, Analyst

In November 2019, at least two VLGCs (very large gas carriers, ships that carry between 50,000 and 80,000 cubic meters of gas) visited an export terminal in Asaluyeh, Iran, an industrial town on the southwestern coast of the country, to load up on liquified petroleum gas (LPG), in violation of US economic sanctions on petroleum and petroleum-related products from Iran, in force since November 2018. After loading in Iran, these ships crossed the Indian Ocean, passed the Strait of Malacca, and arrived at import facilities at several locations in China. Thanks to commercially available satellite imagery, automatic identification system (AIS) data, and other publicly available information, C4ADS can offer insights into this illicit trade, detail how it is conducted, and even identify some of the likely players involved.

Setting the Stage #

As part of the US-China trade war, the Chinese government announced on August 8, 2018 that it would impose a 25% tariff on US-supplied liquified petroleum gas (LPG), a combination of butane and propane commonly used in industrial processes or bottled for household consumption as cooking gas. Two months later, reporting on the effects of the US to China LPG trade, Thompson Reuters stated that there had been zero deliveries of US LPG to China since the enactment of the tariff, a stark contrast to 2017 when the US supplied 20% of China’s LPG demand. It also stated that Chinese buyers were replacing US barrels with LPG from the Middle East, namely UAE, Kuwait, Saudi Arabia, and Qatar.

However, evidence suggests that China also sourced LPG from Iran – an illicit practice as per US economic sanctions on Iranian oil. Executive Order 13846 (issued on August 6th, 2018), authorizes the Secretary of State to impose sanctions on any person who “on or after November 5th, 2018, knowingly engaged in a significant transaction for the purchase, acquisition, sale, transport, or marketing of petroleum or petroleum products from Iran.” The term ‘‘petroleum products’’ includes “unfinished oils, [and] liquefied petroleum gases”. In September 2019, Thompson Reuters reported that despite the cripplingly effective sanctions on its crude oil exports, Iran continued to export petroleum products, such as LPG, at a rate of $500M per month, seemingly undeterred by US policy. Quoting Kpler, an energy market intelligence firm, Reuters estimated that 95% of Iranian exports during the month of June 2019 went to China. Finally, a November 7th, 2019 article from S&P Global Platts cited estimates of ten cargoes shipped from Iran to China in October and between six and ten cargoes in November 2019. The article also noted that each Iranian LPG cargo typically carries 44,000 metric tons.

Who is responsible for carrying out this ongoing trade? And how can law enforcement, the private sector, and others detect ongoing Iranian maritime sanctions evasion?

Iran’s Principal LPG Ports #

We started with a locus of Iranian maritime sanctions evasion – the country’s ports. More specifically, we looked for ships docking at Iranian LPG terminals. According to the US Energy Information Agency (EIA), Iran exports LPG from Asaluyeh, while public reporting indicates that Bandar Imam Khomeini is also an LPG export hub. Iranian media confirms that both sites export LPG, with IRGC-affiliated Tasnim News Agency mentioning three LPG cargoes departing Imam Khomeini and five from Asaluyeh in August 2018.

Our analysis honed in on one location, Asaluyeh, because it represents a vital part of Iran’s natural gas sector. In this area, a series of gas processing facilities are fed by pipeline from the South Pars Gas Field, which is Iran’s portion of the natural gas deposit straddling the maritime border between Iran and Qatar, the world’s largest. As an indication of how critical this location is to Iran, the country’s most advanced air defense system, the S-300, was deployed at Asaluyeh’s airfield in June and July 2019, detailed by our satellite imagery analysis partners at AllSource Analysis here and also spotted on social media.

Asaluyeh is home to the Pars Special Economic and Energy Zone (PSEEZ), 6.5km northwest of the Asaluyeh airfield, which processes gas from the South Pars field. AllSource Analysis also provided a detailed layout of a portion of PSEEZ, Pars Petrochemical Port, in the handy graphic below.

We then zeroed in on vessels arriving at port to investigate just who may be facilitating the Iran-China LPG trade.

AIS Tampering #

C4ADS’s research on vessel positioning data at the Pars Petrochemical Port in PSEEZ suggests that vessels visiting the loading terminals engage in behavior to obfuscate their location, allowing them to evade restrictions on Iranian exports and continue supplying markets with illicit cargo. AIS data indicate that during the months of October and November 2019, 69 unique vessels visited the port. This includes all types such as bulk carriers, container vessels, service vessels and anything else broadcasting an AIS signal. Zeroing in on the tankers, however, reveals that only three unique tanker vessels were broadcasting AIS data at the port, and interestingly, none of these three were LPG tankers. After seeing what we considered a suspicious gap in the data, we turned to another source of information on this port: satellite imagery.

Comparing the sparse AIS data to satellite imagery from Planet demonstrates the inability of AIS to paint a complete picture of port activity. Available imagery shows that ships visiting the port may not be activating their mandatory AIS transmitters while in port, potentially allowing them to evade detection and thus engage in sanctions evasion unnoticed.

This single image from November 30th, 2019 shows four vessels docked at liquid-product export berths. Their visits to these berths, in addition to the visible pipe running down the center of deck, indicate they are tanker vessels. The four tankers in this shot already exceed the number recorded in AIS data for the combined months of October and November 2019 – clearly something is amiss with AIS data and a survey of daily imagery bears that out. While this level of imagery may not provide insight into the identity of ships behind sanctions evasion, it can provide a trigger for analysts to dive deeper.

ID’ing Vessels #

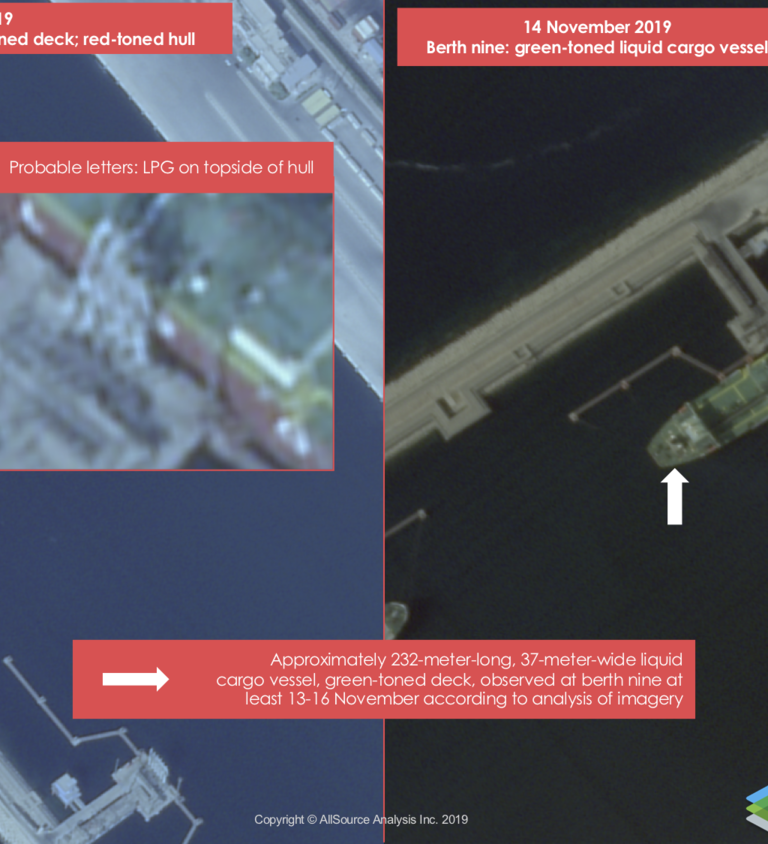

In some cases, paired with AIS data, high-resolution satellite imagery can be used to identify individual vessels appearing at Pars Petrochemical Port at PSEEZ. By comparing the observed vessel length and width with publicly available records of ship dimensions, combined with AIS data and other visible characteristics, we can come to a relatively confident appraisal of a given ship’s identity. For instance, the LPG carrier SEA SAPPHIRE (IMO 9114581) seemed to visit this loading terminal from November 13th – November 16th 2019, though the vessel did not appear in AIS data in port during that period.

Comparing the visual signature of the tanker in a ground-level photo with the satellite image, we can see that the white lettering at the topside of the vessel’s red hull appears to matches that of the vessel pictured by the satellite at PSEEZ. This visual information, combined with the dimensions and some attentive AIS monitoring, supports our identification.

Again, the visual signature of the tanker in a ground-level photo is substantial confirmation of the ship’s identity based on its dimensions and our AIS data sifting. The satellite image shows the vessel’s white lettering on the hull’s blue topside sitting above the red portion of the hull, just visible above the waterline.

The Odyssey of the Sea Sapphire and the Everrich 10 #

After tentatively identifying the involved vessels, we can start to look at where, when, and how they traveled. Our access to detailed maritime data allows us to gain insights into signs that may occur when a vessel is likely to make a “dark voyage” to Iran. In the case of the SEA SAPPHIRE and EVERRICH 10, two such tactics may have been used: first, their reported destinations were not recorded as Asaluyeh as they approached port. And second, they both experienced AIS signal disruptions as they entered the Persian Gulf.

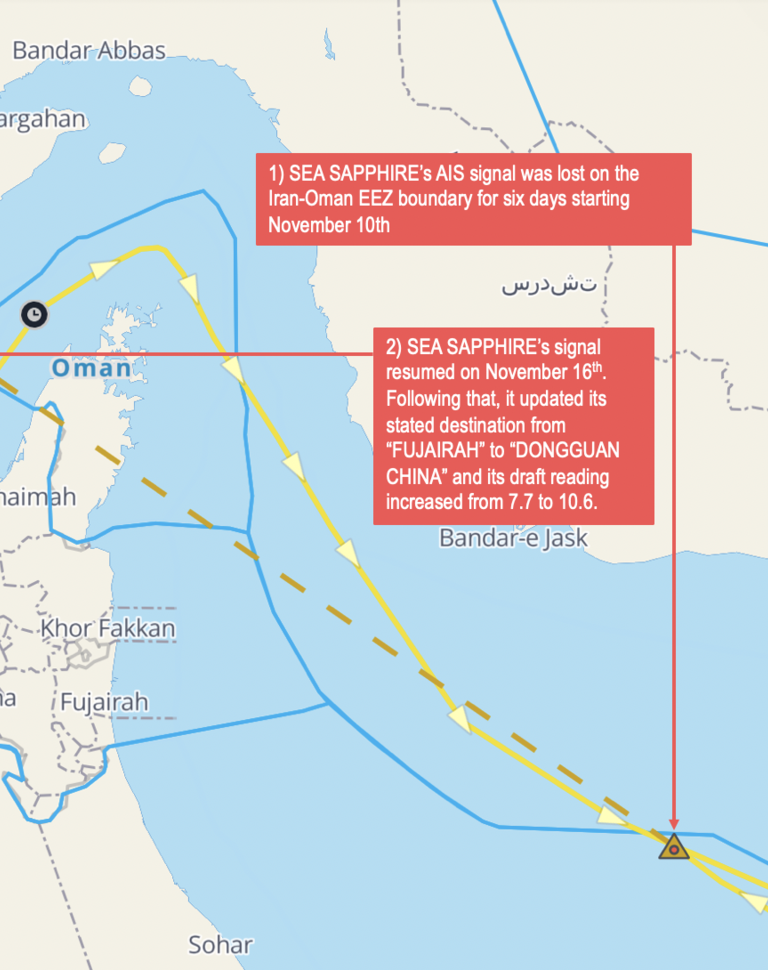

For instance, from its origin in Singapore, on October 30th, 2019, the SEA SAPPHIRE’s publicly reported position was “FUJAIRAH” in UAE. However, after crossing the Indian Ocean, the SEA SAPPHIRE’s AIS signal was lost on November 10th close to the boundary of Oman’s EEZ with Iran in the Gulf of Oman. At no time did the vessel’s publicly stated AIS destination correspond to Asaluyeh or any other Iranian location. On November 16th, the signal once again resumed, at a location close to the confluence of Oman, UAE, and Iran’s EEZ in the Strait of Hormuz.

This gap of roughly six days is more than enough to travel the roughly 1250km to Asaluyeh and back to where the signal resumed, based on SEA SAPPHIRE’s service speed, according to Windward, of 16.7knots (roughly 30km per hour).

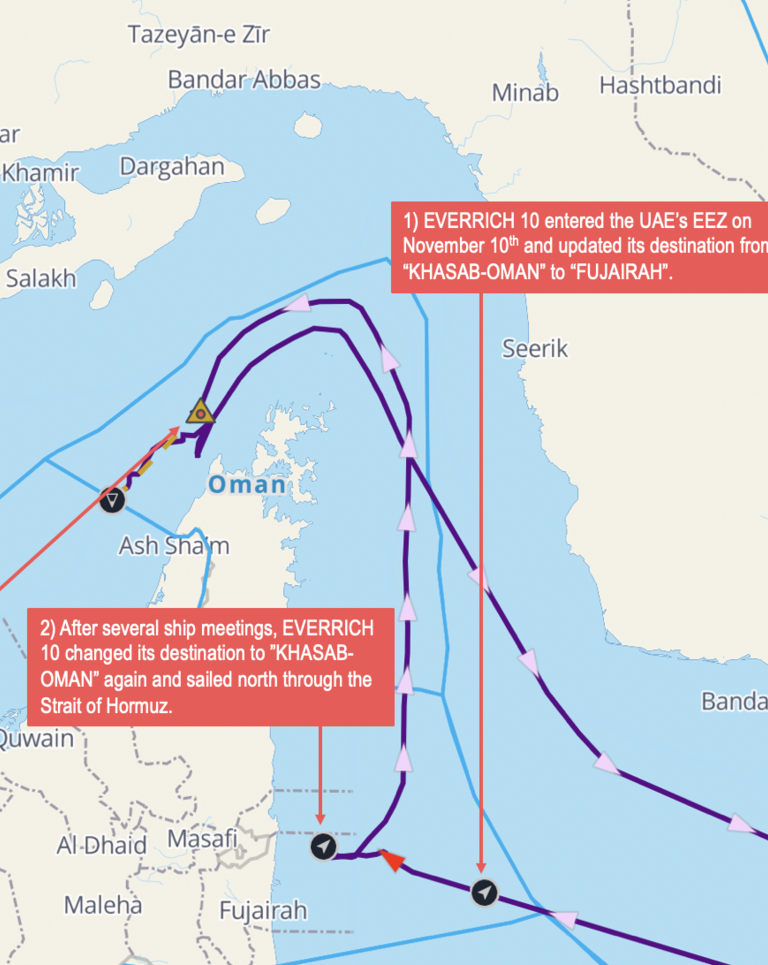

Similar signs were visible for the EVERRICH 10. On October 31st, while EVERRICH 10 was approaching Singapore from China, its destination changed to “KHASAB-OMAN”. The vessel then transited the Strait of Malacca and sailed toward the Strait of Hormuz. The vessel entered the UAE EEZ east of Fujairah, a hub for ship fueling and resupply activity (called bunkering in maritime jargon), on November 10th, changing its destination to “FUJAIRAH”.

After several ship meetings in UAE’s EEZ, on 18 November, its stated destination again changed to “KHASAB-OMAN”. Following this change, EVERRICH 10 sailed through the Strait of Hormuz and its AIS signal was lost in Oman’s EEZ. Eight days later, on November 26th, the ship’s AIS signal resumed and its draft reading, the measure of a ship’s height in the water, was updated to show it was more laden than before. Based on the ship’s service speed of 19.6 knots, according to Windward, (roughly 30km per hour), eight days is more than enough time to travel the 550km from the location where its AIS signal dropped to Asaluyeh and back, accounting for the two days it (or a ship remarkably similar to it) was spotted loading at port. After its AIS came back online, the ship’s destination was updated to reflect its intended delivery destination of “DONGGUAN_CHINA”.

Onshore Networks #

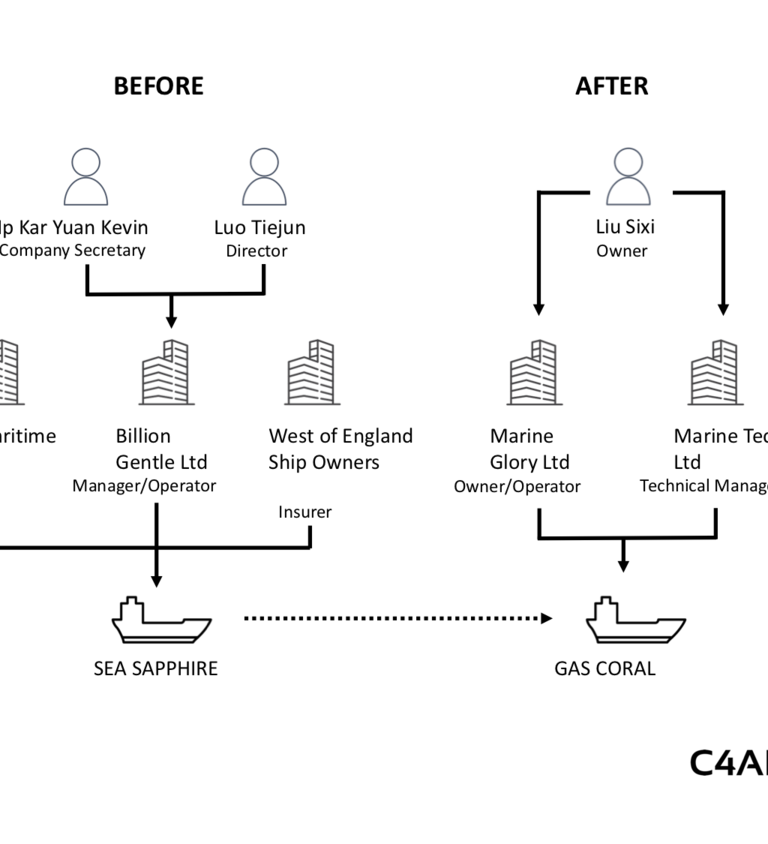

In addition to a pattern of apparent location obfuscation and mis-reporting destinations, the SEA SAPPHIRE also swapped owners and changed its name before delivering its cargo in China. During the period when it was spotted in Iran, between the 13th and 16th of November, the SEA SAPPHIRE was under the ownership of a Liberia-registered company called Lotus Maritime Ltd. and under the operation and management of Billion Gentle Ltd., a Hong Kong-registered company.

The vessel arrived in the Chinese EEZ on December 3rd, 2019, and sailed towards Hong Kong. On the 14th of December 2019 the vessel began broadcasting a new name, flag, and MMSI – the Liberia-flagged SEA SAPPHIRE with MMSI 636018816 became the GAS CORAL, a Panama flagged vessel with the MMSI 370687000. Vessel ownership records indicate that during the month of December, Marine Glory Ltd. became the owner, operator and ship manager of the vessel, while Marine Technical Ltd. became the technical manager. Both are Hong Kong-registered companies and share the same Chinese national as sole owner.

For its part, the EVERRICH 10 has maintained its ownership and management structure since September 2015. TPL Shipping is the group owner and manager of the vessel, while the registered owner is Minh Hai Sea Transport, both registered in Vietnam.

After apparently going through all this trouble to obfuscate their location, mis-report Iranian destinations, and, in the case of SEA SAPPHIRE, change names, where did the LPG vessels deliver their cargo?

According to Windward, on December 14th EVERRICH 10 arrived at a loading terminal in Dongguan, China belonging to Jovo Energy, a firm that operates LPG storage tanks in Dongguan. After departing Dongguan, it sailed to Chaozhou Huafeng Petroleum in Chaozhou, China where it arrived on December 18th.

After its name and ownership change, the GAS CORAL arrived on 18th of December at the same Jovo Energy terminal in Dongguan that EVERRICH 10 visited. After that, it travelled to a loading terminal belonging to Bingang Petrochemical in Longkou, China, arriving on December 30th, 2019.

Conclusion #

The case of the SEA SAPPHIRE and the EVERRICH 10 tell us several things. For one, they serve as compelling evidence of the ongoing trade in illicit LPG between Iran and China. On one hand, Iran’s exports offer a valuable lifeline for the country, which has seen its ability to export crude oil diminish rapidly in the face of sanctions. On the other hand, China’s appetite for LPG was not diminished by the trade war with the United States; rather, it began sourcing the commodity from other exporters, Iran included.

The voyage of the SEA SAPPHIRE and EVERRICH 10 also indicate warning signs that vessels may be making port calls in Iran. Gaps in the broadcasting of AIS transponders, which are mandatory safety equipment according to the International Maritime Organization, and the inaccurate reporting of destinations in the Persian Gulf are methods that shipping industry facilitators may use to avoid detection. Additionally, in the case of the SEA SAPPHIRE, its change in ownership is another twist in its story that could mask its activity or hide its ultimate beneficial ownership. As far as Iranian suppliers, Chinese buyers, and American authorities are concerned, the identity of these ships and their activity is important for understanding when, where, how, and by whom sanctioned trade is carried out. For the time being, given strong demand, some Chinese buyers are likely to continue attempting to import LPG from Iran, and the parties involved in this trade may shift or improve their tactics.

Ongoing monitoring should be a priority for institutions that want to make this trade known or discover parties involved in it. Fully utilizing publicly available sources of information and fusing data together from multiple disciplines and providers allows us and others to peel back the layers of even elaborate efforts to evade sanctions.