The Saab Story

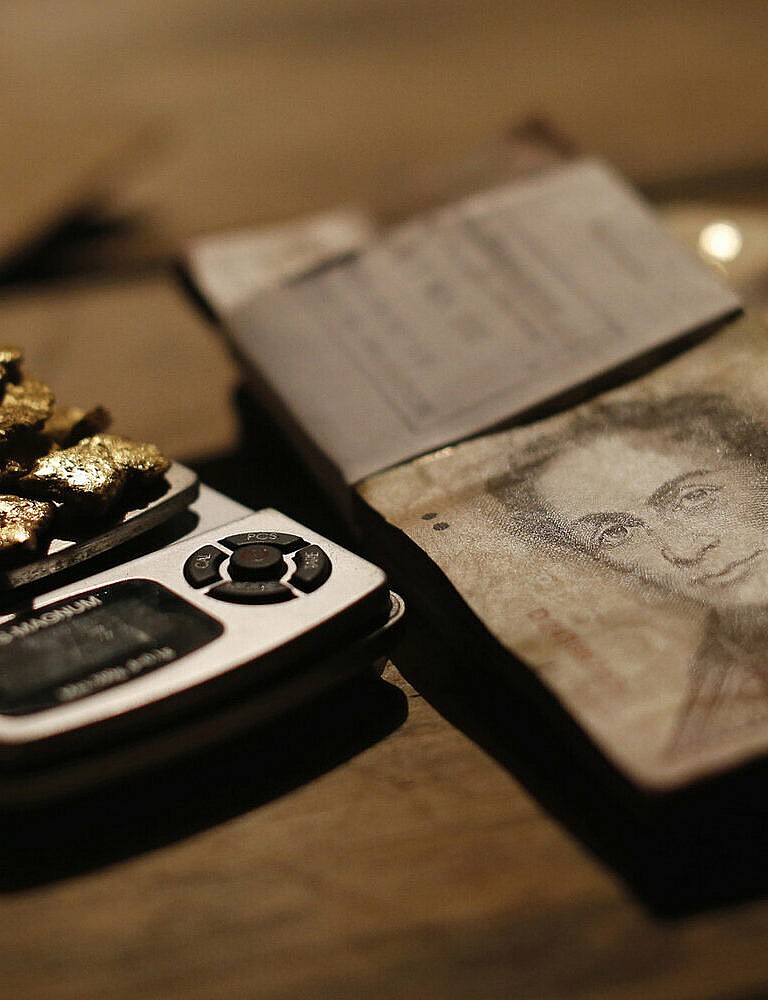

As the United States ratchets up sanctions on Venezuela’s oil sector, the Maduro government has turned to gold to fill state coffers and line the pockets of those in power.

How Venezuela’s Gold Reserves Help Maduro Maintain Power #

As the United States ratchets up sanctions on Venezuela’s oil sector, the Maduro government has turned to gold to fill state coffers and line the pockets of those in power. In an attempt to invigorate the mining sector, the government has permitted a handful of companies to process minerals in Venezuela’s National Orinoco Mineral Arc, a belt of strategic mineral resources designated by Maduro in 2016. To meet the demand for gold and other minerals, thousands of Venezuelans with few other economic prospects have streamed into mining camps across the country’s Mining Arc, where their labor is exploited by the numerous armed groups vying for control of the area. Part of the gold is eventually purchased by Venezuela’s Central Bank, which ships it abroad to pay for goods and services that Maduro needs to keep the economy running.

In May 2020, Bloomberg reported that Venezuela had begun shipping gold from its Central Bank vaults to Iran. In chartering a series of flights to send gold to Iran, Maduro reportedly relied on Alex Saab, a sanctioned Colombian businessman who has previously been accused of creating a global web of companies in Turkey, the UK, the UAE, and elsewhere to siphon money from Venezuela’s low-income food assistance program, and of helping Venezuela sell its gold in Turkey. The Iranian role in Venezuela’s gold trade shows how Venezuela’s reliance on Saab has deepened, and underscores how geopolitical imperatives tie sanctioned actors to the illicit gold trade.

Using corporate records and trade data, C4ADS found evidence that ties Saab to a Venezuelan state-run gold mining venture through a network of shell companies in the UK and Turkey, one of which has already been sanctioned by the US for its role in an earlier gold-for-food swap arranged by Saab with Turkey. This evidence suggests that Saab may have deepened his involvement in Venezuela’s gold sector, moving from simply a fixer responsible for sales to an integral player with interests in mining.

The Saab Story #

lex Saab first gained international notoriety in July 2019, when he was indicted in the US on federal money-laundering charges for allegedly bribing Venezuelan officials and funneling over $350 million to overseas accounts from fraudulent contracts linked to a state housing program in Venezuela. The same month, he was sanctioned by the US for managing a global network of shell companies that allegedly laundered millions of dollars in profits from overvalued contracts linked to the CLAP (Comité Local de Abastecimiento y Producción), Venezuela’s food subsidy program.

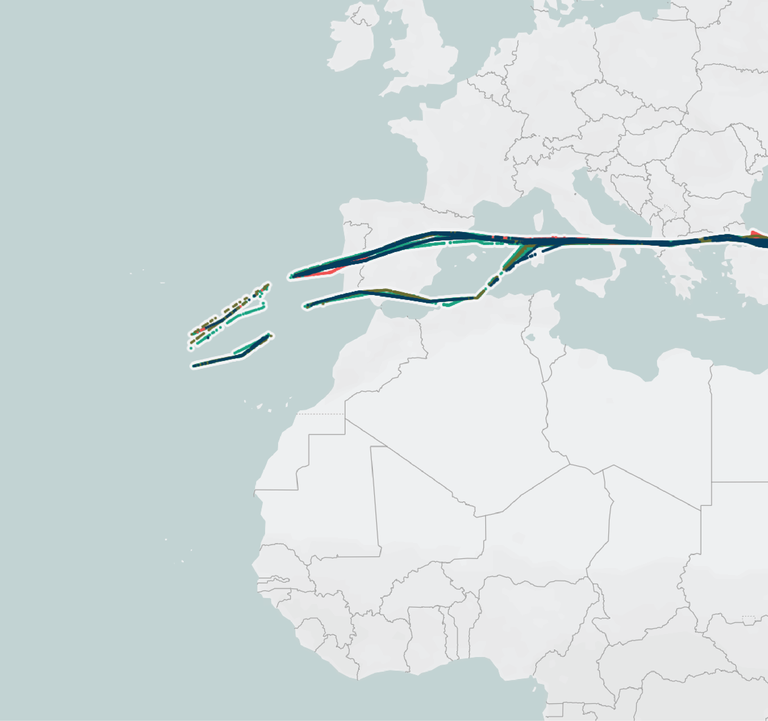

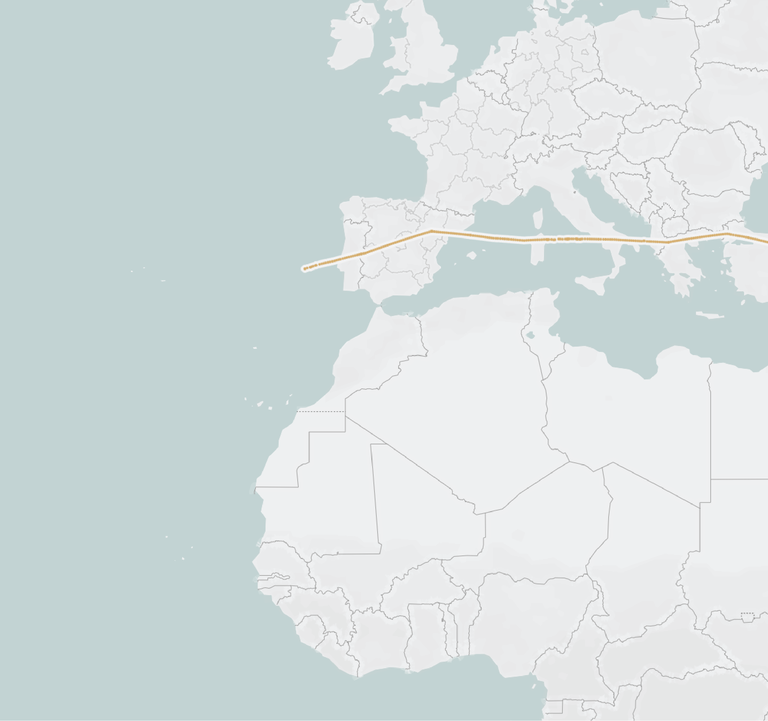

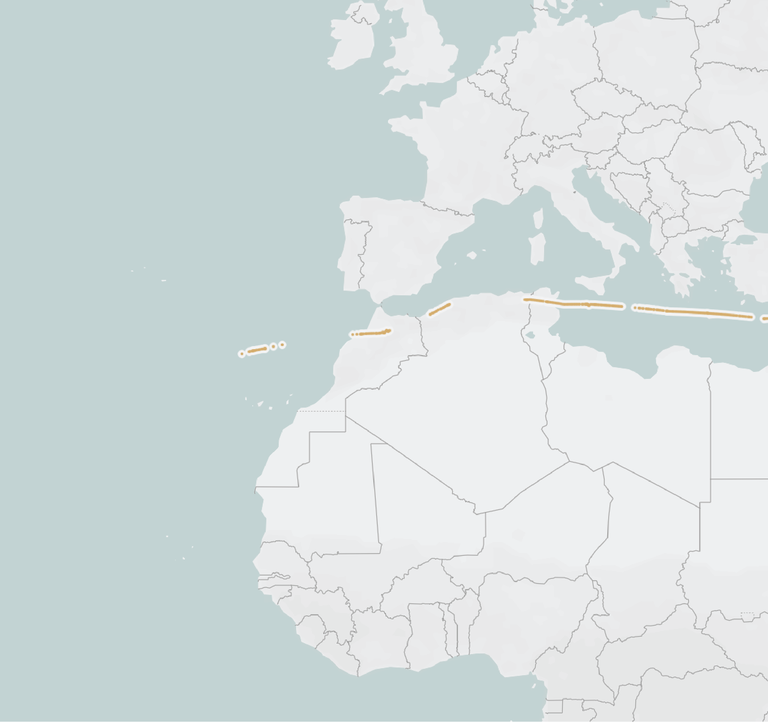

By April 2020, Saab was in the spotlight once again for his alleged role in arranging a gold-for-gasoline swap between the Venezuelan and Iranian governments that is helping both countries stay afloat in the face of US sanctions. On April 22, 2020, an aircraft belonging to Mahan Air, a private Iranian airline sanctioned by the US for its support to the Islamic Revolutionary Guards Corps (IRGC), touched down in Punto Fijo, Venezuela—the first of 29 Mahan flights between the two countries in the weeks that followed. According to sources interviewed by Bloomberg, the flights—which reportedly transported technicians, machinery, and chemical gasoline additives to Venezuela in exchange for gold on the return flights to Iran—were orchestrated by Colombian businessman Alex Saab.

Flight records show that a jet belonging to Conviasa, Venezuela’s state airline, flew to Tehran on April 15 before returning to Venezuela five days later – a timeframe that coincides with the meeting reported by Bloomberg involving Saab and officials from Caracas and Tehran.

Although the two countries have maintained a political and economic alliance since the early 2000s, the series of flights between Venezuela and Iran between April and May 2020 marked the first by Mahan Air since it opened the route between Tehran and Caracas last year.

While this may be the first public report of a gold-for-services arrangement between Venezuela and Iran, it is not the first time that Saab was reported to have helped Venezuela sell its gold reserves abroad. In 2018, the increasingly cash-strapped Venezuelan government began using its gold resources to pay contracts, including those related to its food distribution program. According to the US Treasury Department, Venezuela turned to Saab to help coordinate its gold-for-food program. Saab reportedly arranged the sale of gold to entities in Turkey, which would then transfer funds to an account held by Venezuela’s central bank.

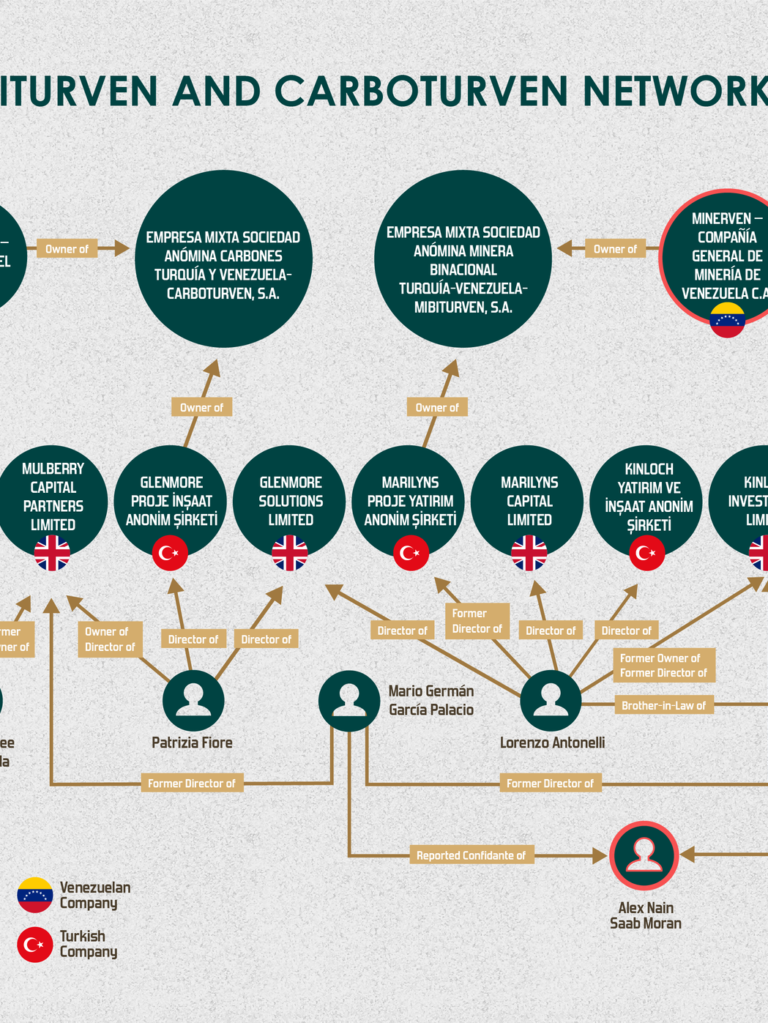

One of the Turkish companies involved in this scheme, Mulberry Proje Yatirim Anonim Sirketi, is linked through overlapping directorship and contact information to a network of companies that now appear to be active in Venezuela’s mining sector, and which themselves may be ultimately controlled by Saab.

Mibiturven: Venezuela’s Gold Mining Venture with a Mysterious Turkish Company #

In 2018, the Venezuelan Ministry of Ecological Mining Development established two joint ventures between Venezuelan state-owned mining enterprises and Turkish companies. One of the ventures, Empresa Mixta Sociedad Anómina Minera Binacional Turquía-Venezuela (Mibiturven, S.A.), was formed by Compañía General de Minería de Venezuela C.A. (Venezuela), which has been under US sanctions since March 2019, and Marilyns Proje Yatirim S.A. (Turkey). In 2018, Mibiturven was granted a 20-year gold mining concession in the state of Bolívar.

The other joint venture, Empresa Mixta Sociedad Anómina Carbones Turquía-Venezuela (Carboturven, S.A.) was formed by Carbones del Zulia S.A. (Venezuela) and Glenmore Proje Insaat S.A. (Turkey). In 2018, Carboturven was granted a 20-year coal mining concession in the state of Zulia.

Marilyns and Glenmore are not just random Turkish companies: they are linked through a network spread across Turkey and the UK that tie back to Mulberry, the Turkish company that Saab allegedly used to send overvalued food shipments to Venezuela and facilitate payments in gold. This connection indicates that Saab may be more than simply an intermediary, and that his involvement in Venezuela’s gold trade may extend to mining interests.

How Mibiturven’s Turkish Stakeholder Ties Back to Alex Saab #

According to corporate registry documentation from the Istanbul Chamber of Commerce, Mibiturven’s Turkish parent company, Marilyns Proje Yatirim S.A. (now named Marilyns Diş Ti̇caret Ve Madenci̇li̇k Anoni̇m Şi̇rketi̇), was incorporated in May 2014. Although the company’s directorship changed sometime in recent years, media reports and other publicly available information indicate that its former director, a twenty-seven-year-old Italian named Leonardo Antonelli, is the brother-in-law of Alex Saab. Records from the Turkish National Gazette indicate that a UK company called Marilyns Capital Limited, for which Antonelli also served as director and majority shareholder, is involved in the Turkish company’s governance.

As of May 2020, Antonelli also served as the director for UK company Kinloch Investments Limited, which is owned by Camilla Fabri, Saab’s alleged wife. Antonelli was preceded in his role as director at the latter company by Mario Germán García Palacios, an alleged confidante of Saab.

In total, C4ADS found five companies in Turkey and the UK for which Antonelli has served has an officer or owner. All are connected through shared addresses, phone, or fax numbers. Two of the Turkish companies also share phone and fax numbers with Mulberry, the Turkish company controlled by Saab that was sanctioned by the US in July 2019 alongside Saab for its role in the food-for-gold swap that he allegedly arranged with Turkey. The network of individuals in control of Mibiturven and Carboturven suggests that Saab is ultimately behind both joint ventures.

Is Mibiturven Actively Producing Gold in Venezuela? #

Publicly available information indicates that Mibiturven is more than simply a shell, and is in fact actively engaged in mining operations. In April 2020, the Venezuelan National Guard arrested a woman with 403 grams of gold stolen from Mibiturven, according to media reports. C4ADS analyzed trade data from Panjiva, a commercial data provider, to gain a more complete picture of Mibiturven’s business activities in the country.

Since March 2019, Mibiturven has received shipments of heavy machinery and other equipment that may be used for mining from companies in Colombia, Hong Kong, Turkey, the United Arab Emirates, India, and Thailand, according to 2019 Trade Data for Mibiturven, S.A. Between January and February 2020, a company listed as “Mineria Binacional Turquia” appears as a co-consignee for three shipments of cyanide totaling 170,000 kilograms from C.I. Papecolve S.A.S., a Colombian company. Cyanide is widely used in the mining industry to process gold ore, and has few industrial applications outside of the minerals sector. Overall, Mibiturven’s import records are consistent with those of other companies that operate gold mining and processing operations, and support the interpretation that the company is actively involved in gold production.

Alex Saab: A Key Player in Venezuela’s Evolving Response to US Sanctions #

In March 2019, the US sanctioned Venezuela’s state gold mining company, Minerven, which has been accused of buying illegal gold from mining operations run by criminal outfits in Venezuela’s southern regions. Illegal gold mining in Venezuela has imposed high costs on the environment and local populations in recent years, leading to high rates of deforestation, mercury contamination, and violent clashes between armed groups competing for control over mines.

As early as October 2018, US officials suspected that some of the gold shipped from Venezuela to Turkey eventually found its way to Iran. The recent series of flights between Iran and Venezuela now provides evidence that gold is making its way directly from Venezuela’s central bank vaults to recipients in Iran. Alex Saab’s alleged role in both schemes illustrates how international networks evolve and adapt to international sanctions, helping regimes that have been shut out of global trade and financial systems access alternative sources of equipment and capital. The international companies highlighted in this post, and the actors that control them, show how the flow of tainted gold has been facilitated by a narrow set of individuals who benefit by helping Maduro remain in power.