Black Earth

As the war in Ukraine drags into its 6th year with limited prospect of resolution, its consequences are not limited to the Donbas, or to the Ukrainians trying to survive on both sides of the firing line. Commercial networks profiting from war extend far afield, from neighboring Russia and South Ossetia, to North Korea and Western Europe. This investigation explores how these networks cross national boundaries and contribute to the prolonging of Europe’s deadliest ongoing conflict.

As the war in Ukraine drags into its 6th year with limited prospect of resolution, its consequences are not limited to the Donbas, or to the Ukrainians trying to survive on both sides of the firing line. Commercial networks profiting from war extend far afield, from neighboring Russia and South Ossetia, to North Korea and Western Europe. This investigation explores how these networks cross national boundaries and contribute to the prolonging of Europe’s deadliest ongoing conflict.

At the heart of Russia’s ongoing war with Ukraine is an illicit trade in coal and metal, which customs records indicate was worth more than $286 million in the last three and a half years alone. This illicit market connects suppliers in Ukraine’s occupied territories with buyers around the world, from the UK to Hong Kong, and even to North Korea. To dodge sanctions and obscure the origins of these products, Russian enterprises have used a complex network of firms located in Moscow, Rostov, and self-declared republics like South Ossetia and Abkhazia. As we’ve seen in other illicit systems, similar networks use secrecy jurisdictions and complex webs of companies to hide their activity. Consequently, global supply chains are tainted by their ill-gotten gains.

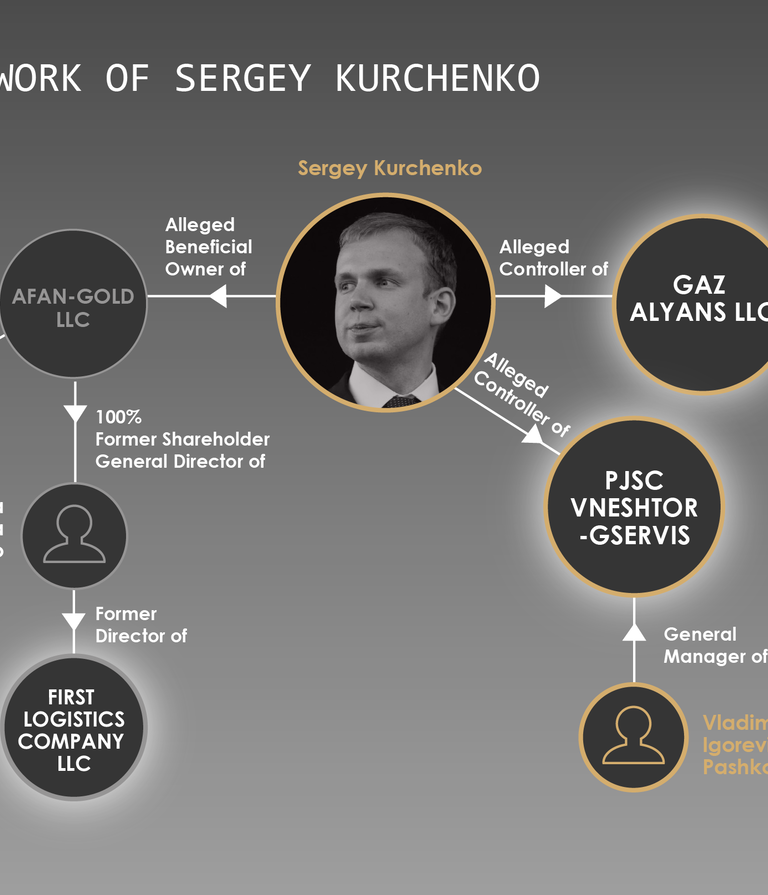

According to public reporting and C4ADS investigation of Russian customs and corporate records, an important figure behind many of these firms is 34-year-old fugitive Ukrainian oligarch Sergey Kurchenko, referred to in local media as the “coal king of the Donbas.” Russian customs records indicate that the Russian company Gaz Alyans LLC, which the the US Department of the Treasury states is owned or controlled by Kurchenko, is the 9th highest payee by US dollar value of exports of anthracite coal from Russia in between 2016 and May 2019. Given Kurchenko’s alleged role in illicitly transferring coal from Eastern Ukraine into Russia, there is a risk that Gas Alyans coal exports from Russia to other nations may contain illicit coal from Ukraine’s occupied territories.

Using trade records, corporate registry information, and photos and videos captured by Ukrainian researchers, C4ADS worked with the Washington Post to identify the scale of this trade, the primary actors involved, and the potential international consumers of coal and metal products illicitly exported from the Donbas.

A Conflict Economy in Europe #

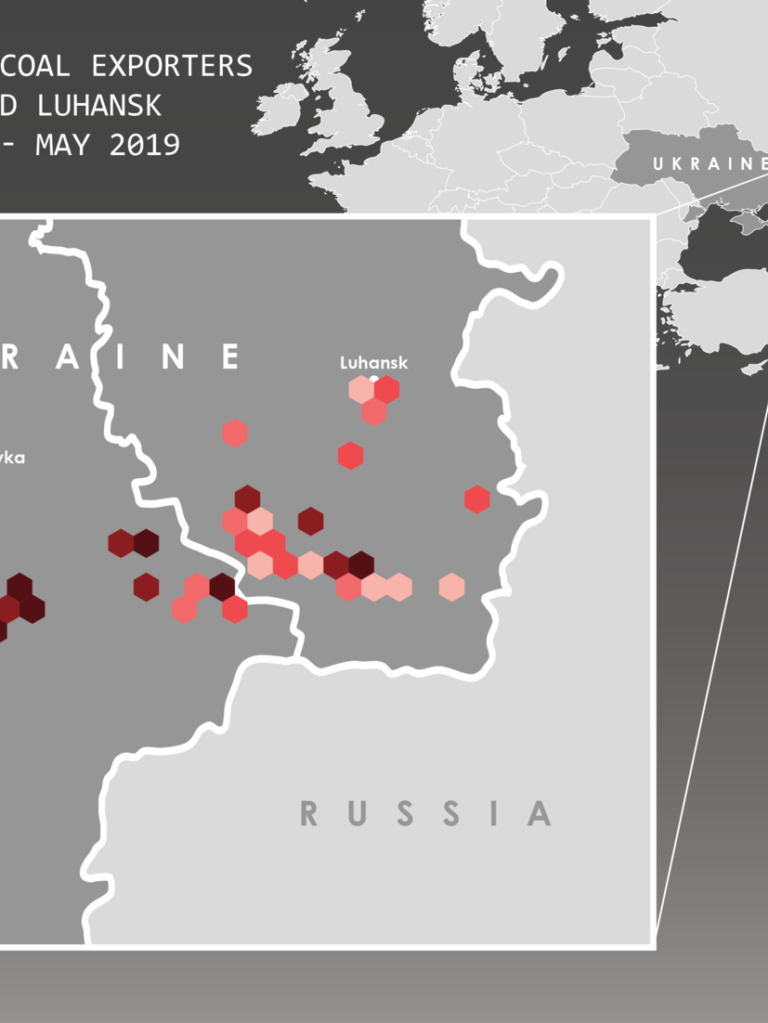

When Russian forces invaded Ukraine’s Donbas region in 2014, the region they seized contained 115 of the 150 coal mines in Ukraine. The Donbas is rich in mineral resources, particularly energy-dense anthracite coal. While Russia and the self-declared states of the Donetsk Peoples Republic (DNR) and Luhansk Peoples Republic (LNR) waged war against Ukraine, actors on both sides of the border found a way to exploit this natural wealth. First reported in 2015, Russian enterprises began exporting large quantities of coal and metal products from the occupied territories into Russia.

Russian enterprises, collaborating with the authorities of the DNR and LNR, have moved 3.2 million metric tons of coal from the occupied territories of Ukraine into Russia between 2016 and 2019 according to Russian import declarations. Some Russian companies importing this coal sell it to domestic consumers in Russia and on international markets. There is a hefty profit to be made — Russian customs records indicate that imports of anthracite coal from Eastern Ukraine have a reported value of roughly $0.04 per kilogram, while Russian export declarations for the same companies involved in buying Donbas coal state that they sell anthracite internationally for around $0.07 per kilogram. If these companies sold all of the anthracite coal sourced from Eastern Ukraine at these rates, they would stand to make potential revenue of more than $96 million dollars.

The US Department of the Treasury Office of Foreign Asset Control (OFAC) has sanctioned a number of individuals and companies involved in this activity; despite this, sanctioned individuals continue to trade in these products internationally. This trade is reported to sustain the self-declared republics in their ongoing Russian-supported war with Ukraine. Local media reporting indicates that this activity has persisted as recently as April 2020, despite market disruption as a result of the COVID-19 pandemic.

A Question of Scale #

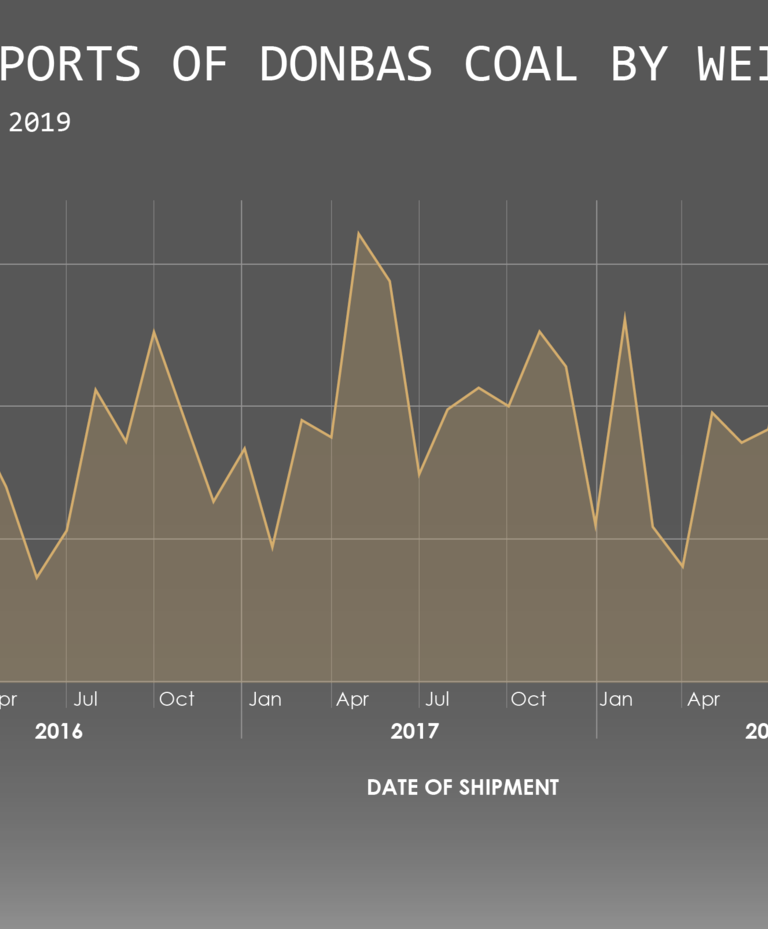

Using Russian import declarations, C4ADS found that between January 2016 and May 2019, Russian companies imported $129,142,962.05 worth of coal from the occupied territories of Eastern Ukraine.

Judging by the same import declarations, Donbas-origin anthracite coal accounts for 97% of imports of anthracite into Russia in this period by dollar value and weight. These imports peaked in 2017, but have continued through 2019 and 2020.

The Players #

On the Donbas side, this trade is largely controlled by enterprises under the nominal control of the self-declared republics in Donetsk and Luhansk. According to Russian import declarations, the top exporters by dollar value are State Enterprise, Republic Center Trading House “Coal of Donbas” and State Unitary Enterprise of Luhansk Peoples Republic “Anthracite” of the Donetsk and Luhansk Peoples Republics respectively. Statements by LNR and DNR authorities indicate that these enterprises are officially under the control of the self-declared governments of the region. Consequently, the revenue of these enterprises presumably enriches the nominal governments of Donetsk and Luhansk, and allows them to sustain their Russia-supported war with Ukraine.

The Russian side is similarly dominated by a few buyers. The top nine Russian importers of coal from the occupied territories of Ukraine account for 71% of imports of this coal by weight in this period. Of these, the dominant structures are reportedly associated with fugitive Ukrainian oligarch Sergey Kurchenko, who was sanctioned by OFAC for his role in this illicit trade. Russian media reports indicate that Kurchenko’s businesses were the only companies authorized by the Russian government to engage in this trade between March 2018 and November 2019. Following complaints from a variety of other firms, Kurchenko has been deprived of his monopoly on Donbas coal. Despite sanctions and increased competition, Russian customs records and local reporting suggest that Kurchenko and his companies, such as, Gaz Alyans, continue to be major players.

The Oligarch-Alchemist #

Kurchenko is a 34-year-old Ukrainian oligarch alleged to reside in Moscow as of Spring 2020. Ukrainian sources and international media claim there is a close relationship between Kurchenko and Viktor Yanukovych, former President of Ukraine. Media reports also allege that Kurchenko has collaborated with Russian state entities, including presidential adviser Vladislav Surkov and Russian intelligence.

OFAC press releases and Russian investigative media claim that Kurchenko is the controller of PJSC Vneshtorgservis and Gaz Alyans LLC, two of the most significant entities in the transfer of Donbas-origin coal and metal into Russia and beyond. Vneshtorgservis has reportedly controlled the metallurgical plants and coal mines “nationalized” by the LNR and DNR since April 4, 2017. Russian media indicate that in March 2018, the company Gaz Alyans LLC became the only company in Russia officially authorized by the Russian Ministry of Economic Development to import coal from the DNR and LNR. Based on the research of Ukrainian investigators and information in Russian corporate documents, C4ADS identified other companies likely engaged in the Donbas coal trade as companies within Kurchenko’s extended network — First Logistics Company LLC and Center for Effective Logistics Solutions LLC.

According to Russian import declarations, Gaz Alyans LLC frequently appears as the party to receive payment, or ‘payee’, for shipments of coal products from the occupied territories of Eastern Ukraine. In these documents, Gaz Alyans LLC was the payee for Russian imports of coal from DNR and LNR with a total value of approximately $38 million, and a total weight of roughly 119 thousand metric tons between 2016 and May 2019. This accounts for 31.7% of imports of Donbas-origin coal products into Russia in this period by weight.

Gaz Alyans isn’t just paid for coal coming out of the Donbas into Russia — in Russian export declarations, it’s also recorded as being paid for Russian exports of coal abroad.

Who’s Buying #

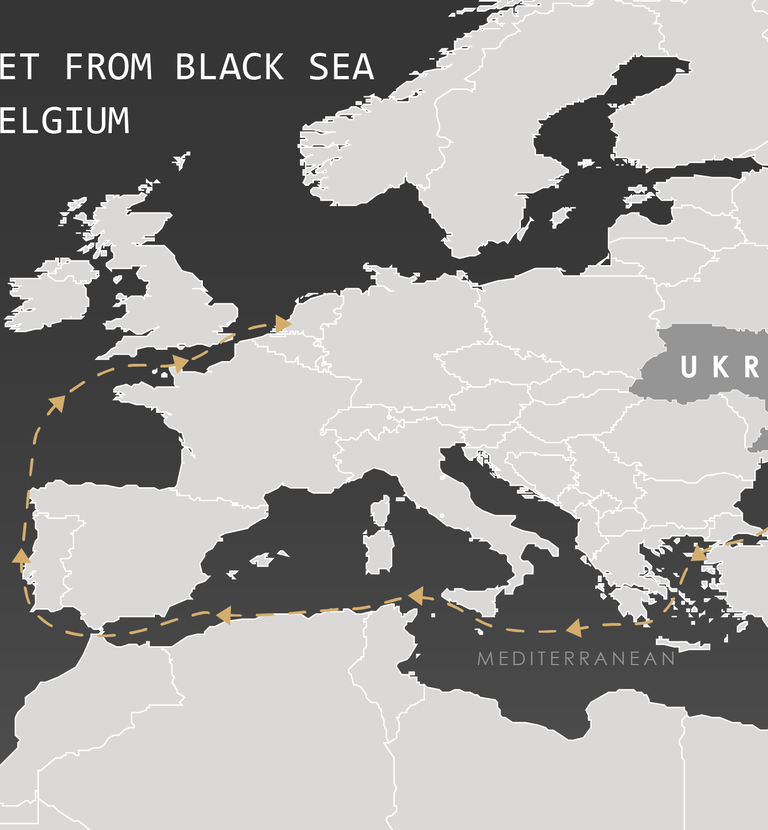

Geographic location of consignors and consignees on shipments of coal products with Gaz Alyans LLC identified as payee on export declarations. Arcs represent paths of shipment from consignor (yellow) to consignee (red)

Between 2016 and May 2019, Gaz Alyans LLC appears as the payee party on export declarations of coal products from Russia with a total reported value of roughly $2.9 billion dollars. This figure far exceeds the extraction of coal products from the Donbas indicated by Russian customs records, and may suggest that Gaz Alyans also exports Russian-origin coal. These shipments were bound for Hong Kong, the Netherlands, the United Kingdom, Poland, Turkey, and other jurisdictions. Buyers included a Russian-North Korea joint venture and a company in the self-declared Republic of Abkhazia, among others.

Buyers of coal products exported by Gaz Alyans LLC and its partners include companies that appear to conduct licit business, and which may be unwittingly exposed to the risk of sanctions violation and the purchase of illicitly sourced coal. Other companies purchasing from Gaz Alyans are offshore structures that may function as an additional layer of obfuscation, hiding the ultimate buyers of these goods.

RasonKonTrans #

A number of Gaz Alyans’ customers are based in geopolitically sensitive locales. They include companies in Russian-sponsored separatist territories like Abkhazia and pariah states like North Korea. RasonKonTrans is one such customer — a Russian-North Korean joint venture in the port of Rajin, North Korea. While a UN exemption permits RasonKonTrans to conduct international business from North Korea, its purchases from US OFAC-sanctioned Gaz Alyans are evidence of another type of possible sanctions violations.

According to Russian export declarations from 2018 and 2019, Gaz Alyans LLC is the payee on coal shipments to RasonKonTrans with a total value of more than $41 million dollars. These shipments were sent by companies that include Gaz Alyans itself.

RasonKonTrans occupies a niche market — it is exempt from UN sanctions on exports of coal and metal products from North Korea, so long as these products originate outside of North Korea. This exception applies specifically to Russian coal and coal from other states, so long as the exporting state notifies the North Korea Sanctions Committee in advance.

By purchasing coal from Gaz Alyans, RasonKonTrans is exposed to the risk of acquiring Donbas-origin coal. While it is not possible to determine whether the coal shipped to RasonKonTrans originated from Eastern Ukraine using publicly available information, these transactions at the very least may constitute a violation of US OFAC sanctions on Gaz Alyans.

Vartech Enterprises #

One of the largest customers of Kurchenko’s companies is the Hong Kong-based Vartech Enterprises Ltd. Public reporting and corporate records link Vartech to other networks involved in the illicit sale of coal and metal from Eastern Ukraine. According to Russian export declarations, Vartech received more than $579 million worth of coal products and more than $1.4 billion in metal products with Gaz Alyans listed as payee on those transactions.

According to Vartech’s website, the company engages in “international wholesale trade in metals, metal ores, solid, liquid and gaseous fuels and coal products.” Russian trade records indicate that the company has received shipments from Russia with a total reported value of $2 billion between 2016 and May 2019. 84% of these shipments by value were sent by companies indirectly affiliated with Sergey Kurchenko, including First Logistics Company LLC, Gaz Alyans LLC, and Center for Effective Logistics Solutions LLC.

The only public mentions of Vartech Enterprises Ltd. are in an article on a Ukrainian blog, and in a series of Ukrainian court cases. These Ukrainian legal cases concern the October 2018 seizure of 3 million tons of hot rolled steel and steel alloy from aboard the vessel COMET (IMO 9146106) which allegedly were bound for a German buyer but addressed to recipient Vartech Enterprises Ltd. Ukrainian authorities seized these products after determining that they originated from Alchevsk Metallurgical Works, a factory in Eastern Ukraine known to be under the control of the Luhansk Peoples Republic.

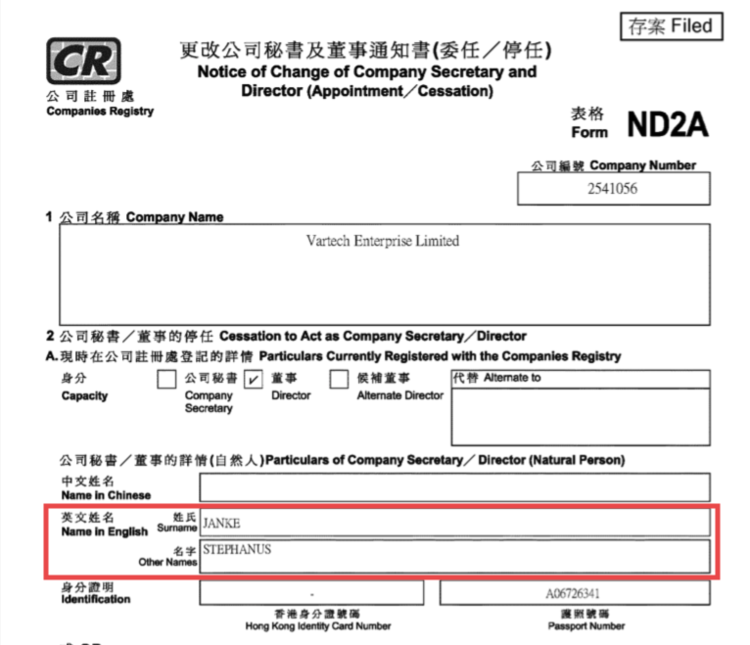

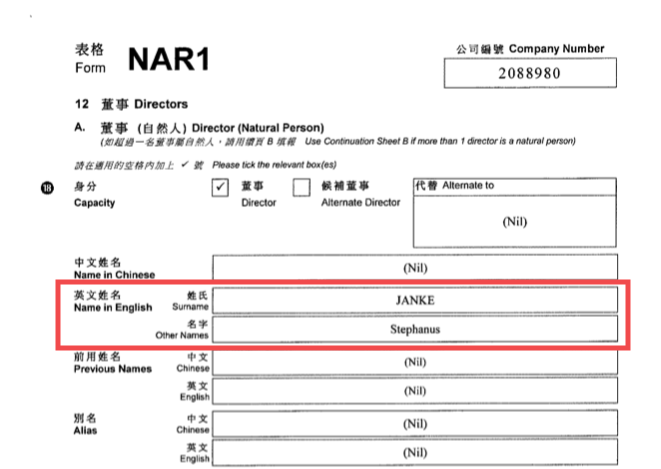

Vartech’s corporate network also links the company to the illicit trade in Donbas coal. Stephanus Janke is a South African national who is the director of Vartech Enterprises Ltd., and who is also the director of the Hong Kong company Grecol Ltd. Legal records connect Grecol Ltd. to another major player in the illicit trade in Donbas coal: Alexander Melnychuk, a former Deputy Minister in the LNR, sanctioned by US OFAC in 2018 for his involvement in the illicit coal trade. A 2014 Ukrainian court case cited property seized in an office space in Kyiv, including seals for a number of companies owned by Melnychuk. Documents for Grecol Ltd. were also uncovered in the seizure.

Dirty Business #

These networks and their illicit activity represent more than just sanctions evasion — this trade in coal and metal constitutes a conflict economy. The actors involved in exporting coal from Eastern Ukraine are engaged in funding the hot war between Ukraine and Russia, denying Ukraine tax revenue, and even degrading the local environment. The value of this trade, documented in customs records, suggests that profit is a significant hurdle to achieving peace in Ukraine.

C4ADS’ investigation into Donbas coal illustrates how a small group of illicit actors can penetrate markets around the world. This very reliance on the transnational systems of trade and finance, however profitable, also makes them vulnerable to action by law enforcement and regulators. With the right tools, private companies, national regulators and law enforcement, and even concerned citizens can all play a role in disrupting this trade.