Off The NASDAQ, Still On The High Seas

In this update to our 2022 Net Worth report, we chart how Pingtan Marine Enterprise and Fuzhou Honglong Ocean Fishing entities have fared in the face of Western sanctions and enforcement actions — finding that they have largely continued to operate with minimal disruption and, in some cases, expanding operations.

C4ADS’ 2022 report Net Worth explored IUU fishing and forced labor aboard vessels controlled by the China-based fishing company Pingtan Marine Enterprise (PME) and its affiliate company Fuzhou Honglong Ocean Fishing Co Ltd. (Honglong).[1] That December, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned PME, its chairman and CEO Zhuo Xinrong, and Honglong for “serious human rights abuse.”[2] This sanction banned any U.S. transactions involving property controlled by PME, making it illegal to import seafood sourced from PME vessels.[3] It marked a turning point in counter-IUU efforts as the first sanctions package to target human rights abuses on fishing vessels, pioneering a new enforcement mechanism against crimes at sea.[4] It was also the first sanctions designation to be levied against an entity listed on the NASDAQ, where PME’s shares had traded since 2013.[5] Complying with the sanctions, the NASDAQ delisted PME in April 2023, blocking global investments in the company.[6]

Three years after Net Worth, we revisited the PME network to examine how it has fared following U.S. sanctions and its NASDAQ delisting. Three key takeaways emerged:

1. Fishing activity by PME-linked vessels has not significantly changed.

Following the sanctions and delisting, PME and Honglong lost the United States as both a direct market for seafood products and a venue to raise capital. However, PME had rarely engaged with the United States as a direct market, instead shipping its catch directly back to China, where all of its revenue was generated as of 2021.[7]Moreover, sanctions from any one country do not directly affect fishing authorizations by the regional bodies that directly govern PME’s fleet activity, such as the South Pacific Regional Fisheries Management Organization (SPRFMO) or North Pacific Fisheries Commission (NPFC).[8] Even if PME vessels had lost these authorizations, more than half of the PME fleet operates in regions of the Atlantic and Indian Oceans where no regulatory body exists to govern their operations.[9] The activity of PME- and Honglong-owned vessels in 2023 and 2024 appears largely consistent with pre-sanctions fishing patterns, suggesting that any financial hardship caused by sanctions and delisting had minimal influence over their operations.[10] In fact, known identifiers for PME- and Honglong-owned ships showed a slight increase in AIS transmission time in the year following the sanctions relative to the year prior.[11]

While the NASDAQ delisting may have reduced PME’s liquidity, according to SEC filings the company was already reliant on subsidies from the Chinese government, tens of millions of USD in bank loans, and personal financing from its CEO to sustain its cash flow.[12]Government press releases indicate that PME and Honglong continue to receive financial support from Fujian Province, which collectively granted them a total of at least 32.997 million RMB (US$4.52 million) from 2023 through 2024 for “distant water fishing product return shipping assistance.”[13]

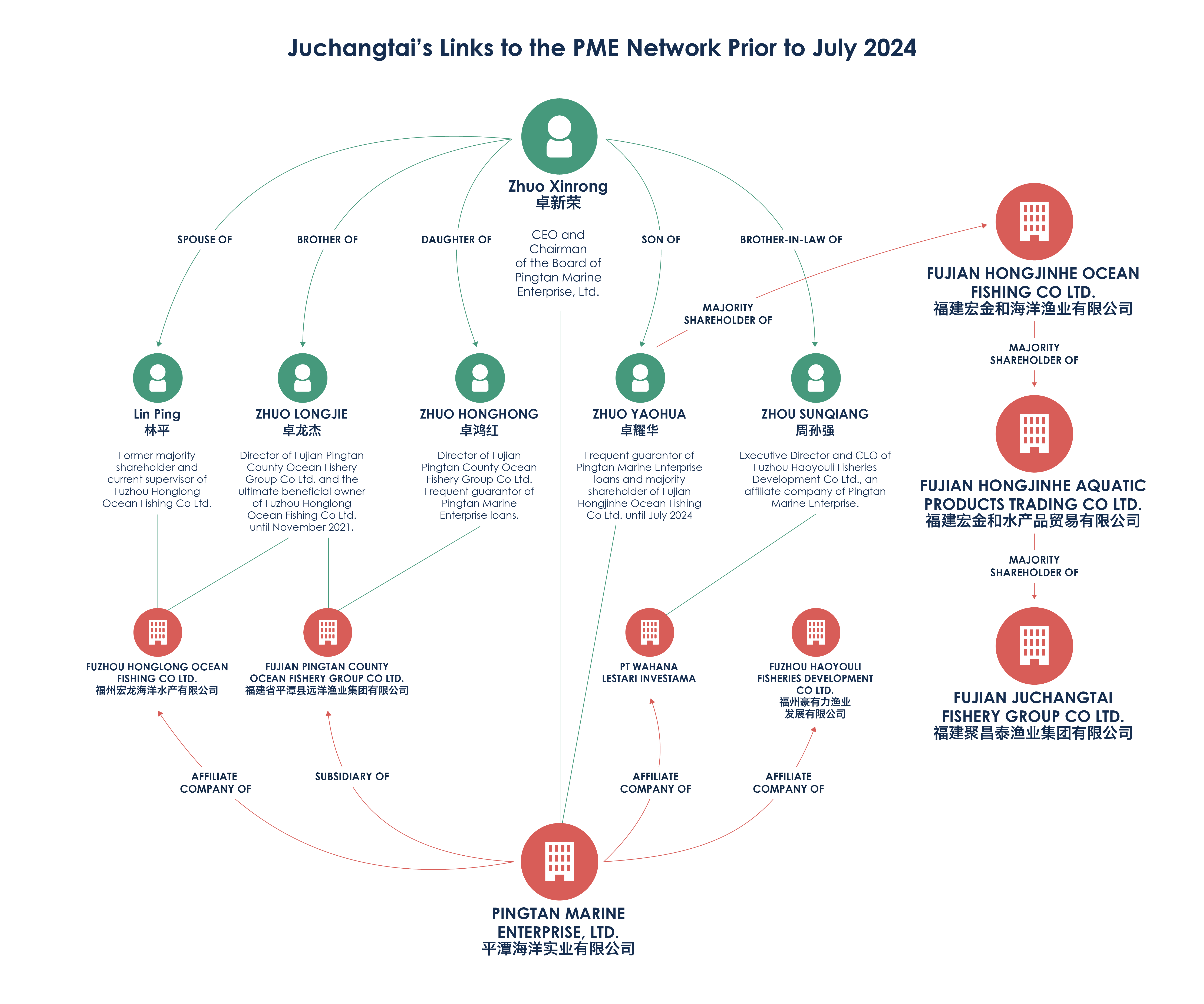

2. The family of PME CEO Zhuo Xinrong began operations under a new, non-sanctioned company called Juchangtai.

The active fishing company Fujian Juchangtai Fishery Group Co., Ltd. (Juchangtai) appears to be a previously unreported arm of the PME network that has emerged since 2022.[14] Chinese corporate records indicate that Fujian Hongjinhe Ocean Fishing Co., Ltd. (HJH), Juchangtai’s parent company, had direct ties to the Zhuo family as recently as July 2024.[15]

Juchangtai and HJH were founded in late 2021, before the sanctions were levied.[16] Juchangtai acquired and began operating eight squid fishing vessels in July 2022.[17] Records show that at HJH’s founding, Zhuo Yaohua, a name match for the son of PME chairman and CEO Zhuo Xinrong, owned a controlling 80% of the company, which he maintained until July 2024.[18] Zhuo Yaohua previously served as a guarantor for multiple PME loans used to purchase fishing vessels, as reported in Net Worth.[19]PME’s network connectivity depends heavily on family ties; Zhuo Xinrong’s brother and wife also served as the ultimate beneficial owner and supervisor, respectively, of Honglong.[20] Juchangtai and Honglong have registered addresses in the same Fuzhou office complex, evidencing further connections between Juchangtai and the PME network.[21]

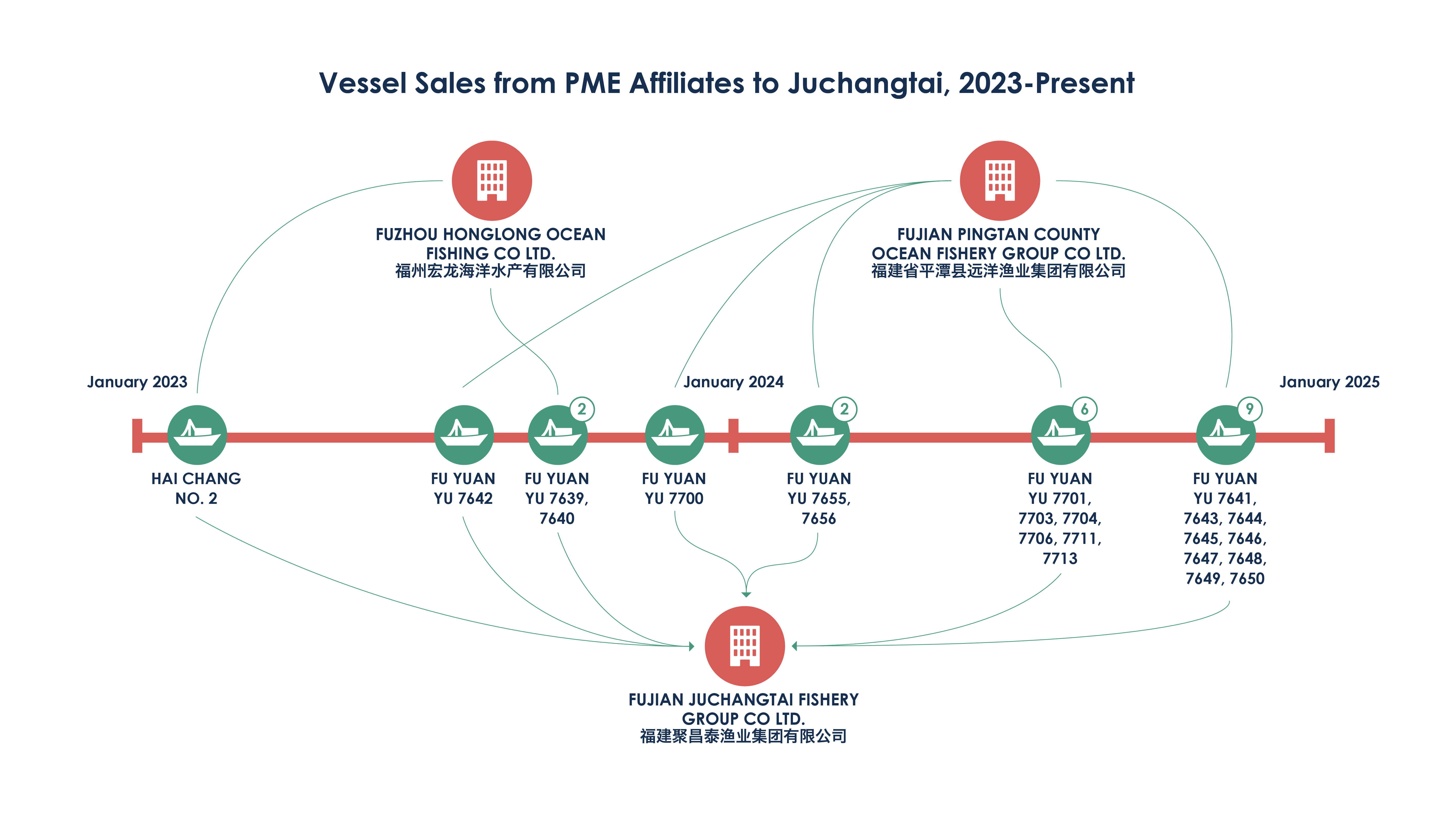

3. PME and Honglong are selling fishing vessels to Juchangtai.

In January 2023, a month after the OFAC sanctions, Honglong sold the reefer Hai Chang No. 2 (IMO 9756573) to Juchangtai, the first direct transaction between the PME network and its new arm.[22] Since the sanctions, Juchangtai has acquired 23 vessels, 22 of which came directly from PME or Honglong.[23] Most of the transactions are relatively recent; Fujian Pingtan County Ocean Fishery Group Co., Ltd. (“Pingtan Fishing”), PME’s primary fishing subsidiary, sold 15 ships to Juchangtai from July through August of 2024.[24] The Juchangtai fleet includes 29 fishing vessels and two refrigerated cargo ships as of May 2025, meaning that PME and Honglong supplied approximately 71% of the fleet.[25]

Note: The names of most of the vessels shown in this graphic changed after being sold. The names used here are their current names as of May 2025.

Reputational damage from the sanctions and delisting continues to follow the PME network in English-language reporting. In March 2025, SeafoodSource reported a large lending pledge by the Fuzhou-based Haixia Bank to Fujian’s distant water fishing industry, naming both PME and Honglong as U.S.-sanctioned entities expected to benefit from the funds.[26] While their continued notoriety in the media can disincentivize business dealings with PME, enforcement action must be multilateral and coordinated to tangibly influence the activity of networks implicated in IUU fishing.

C4ADS’ upcoming report Keeping the Lights On explores this broader approach to combatting IUU fishing, looking beyond corporate structures to uncover the network of on- and offshore enablers that allow the distant water squid fleet to operate in the high seas surrounding South America. As of May 2025, PME, Honglong, and Juchangtai collectively own and operate 64 squid vessels authorized to fish in the SPRFMO convention area.[27] Keeping the Lights On will identify enabling actors—including port agents, reefers, tankers, and novel support systems—as key points of enforcement leverage against distant water fishing vessels, including those of the PME network.

Don’t miss Keeping the Lights On. Sign up for C4ADS’ IUU mailing list here to be the first to read the report once it’s published, and make sure you register for our Staying Afloat webinar on June 11, 2025 to learn more about our work on these critical issues.

[1]Brush, Austin, and Utermohlen, Mary: “Net Worth How the Chinese Government & US Stock Investors Are Funding the Illegal Activities of a Major Chinese Fishery Company.” C4ADS, March 23, 2022. https://c4ads.org/wp-content/uploads/2022/04/NetWorth-Report.pdf.

[2]“Treasury Targets Serious Human Rights Abuse Aboard Distant Water Fishing Vessels Based in the People’s Republic of China.” U.S. Department of the Treasury, December 9, 2022. https://home.treasury.gov/news/press-releases/jy1154.

[3]“Treasury Targets Serious Human Rights Abuse Aboard Distant Water Fishing Vessels Based in the People’s Republic of China.” U.S. Department of the Treasury, December 9, 2022. https://home.treasury.gov/news/press-releases/jy1154.

[4]“2022 Global Magnitsky Human Rights Accountability Act Annual Report.” Federal Register, March 21, 2023. https://www.federalregister.gov/documents/2023/03/31/2023-06749/2022-global-magnitsky-human-rights-accountability-act-annual-report.

[5] “Pingtan Marine Enterprise Responded to the Designation of Being included in the SDN List by the U.S Department of the Treasury’s Office of Foreign Assets Control.” Nasdaq, Inc., December 16, 2022. https://www.nasdaq.com/press-release/pingtan-marine-enterprise-responded-to-the-designation-of-being-included-in-the-sdn;

“Treasury Targets Serious Human Rights Abuse Aboard Distant Water Fishing Vessels Based in the People’s Republic of China.” U.S. Department of the Treasury, December 9, 2022. https://home.treasury.gov/news/press-releases/jy1154.

[6]“Delisting of Securities of Pingtan Marine Enterprise Ltd.; SRAX, Inc.; SVB Financial Group; Signature Bank; Codiak BioSciences, Inc.; PLX Pharma Inc.; Virgin Orbit Holdings, Inc.; Kalera Public Limited Company; Pear Therapeutics, Inc.; and Intelligent Med.” Nasdaq, Inc., April 28, 2023. https://ir.nasdaq.com/news-releases/news-release-details/delisting-securities-pingtan-marine-enterprise-ltd-srax-inc-svb.

[7] “2020 Annual Report Pursuant of the Securities Exchange Commission Pingtan Marine Enterprise” United States Securities and Exchange Commissions, 2021. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001517130/000121390021052493/f10k2020_pingtanmarine.htm

[8] SPRFMO Record of Vessels. South Pacific Regional Fishing Management Organisation. Accessed May 15, 2025. https://sprfmo.org/vessels;

Member/CNCP Flagged Vessels Register. North Pacific Fisheries Commission. Accessed May 15, 2025. https://www.npfc.int/compliance/vessels;

S&P Global Maritime Intelligence Risk Suite.

[9] S&P Global Maritime Intelligence Risk Suite;

The vast majority of the PME-linked vessel network fishes for squid. SPRFMO and NPFC govern two major global squid fishing grounds, but the fishery is unregulated in the Southwest Atlantic and Northwest Indian Oceans.

[10] Global Fishing Watch, https://globalfishingwatch.org/

[11] S&P Global Maritime Intelligence Risk Suite;

Global Fishing Watch Map. Details available upon request.

[12] “2020 Annual Report Pursuant of the Securities Exchange Commission Pingtan Marine Enterprise” United States Securities and Exchange Commissions, 2021. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001517130/000121390021052493/f10k2020_pingtanmarine.htm

[13] Fujian Provincial Ocean and Fisheries Bureau. “2023年省推动远洋渔业高质量发展补助资金项目拟分配方案” (Allocation plan for Fujian Province’s subsidy funds for promoting high-quality development of offshore fisheries in 2023) (September 13, 2023). http://hyj.fuzhou.gov.cn/zwgk/tzgg_3361/202309/P020230913629932837232.xlsx.;

Fujian Provincial Ocean and Fisheries Bureau. “2024年福建省推动远洋渔业高质量发展补助资金拟分配方案” (Allocation plan for Fujian Province’s subsidy funds for promoting high-quality development of offshore fisheries in 2024) (July 15, 2024). https://hyj.fuzhou.gov.cn/zwgk/tzgg/202407/P020240715594123596529.xls.

[14] Chinese corporate registry. Details available upon request;

S&P Global Maritime Intelligence Risk Suite

[15] Chinese corporate registry. Details available upon request.

[16] Chinese corporate registry; details available upon request.

[17] S&P Global Maritime Intelligence Risk Suite

[18]“子承父业不安逸,90后副主席卓耀华”敢闯” – 华人头条.” (The son inherits his father’s business and is not at ease. Zhuo Yaohua, the post-90s vice chairman, dares to take risks) 华人头条, July 10, 2019. http://www.52hrtt.com/ksl/n/w/info/G1562140016950;

Chinese corporate registry; details available upon request.

[19]“2020 Annual Report Pursuant of the Securities Exchange Commission Pingtan Marine Enterprise” United States Securities and Exchange Commissions, 2021. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001517130/000121390021052493/f10k2020_pingtanmarine.htm

[20] Brush, Austin, and Utermohlen, Mary: “Net Worth How the Chinese Government & US Stock Investors Are Funding the Illegal Activities of a Major Chinese Fishery Company.” C4ADS, March 23, 2022. https://c4ads.org/wp-content/uploads/2022/04/NetWorth-Report.pdf.

[21] Chinese corporate registry; details available upon request.

[22] S&P Global Maritime Intelligence Risk Suite

[23] S&P Global Maritime Intelligence Risk Suite

[24] S&P Global Maritime Intelligence Risk Suite

[25] S&P Global Maritime Intelligence Risk Suite

[26] Godfrey, Mark. “Chinese Bank Earmarks Nearly USD 3 Billion in Lending to Provincial Distant-Water Fleet.” SeafoodSource. Diversified Communications, March 20, 2025. https://www.seafoodsource.com/news/supply-trade/chinese-bank-earmarks-nearly-usd-3-billion-in-lending-to-provincial-distant-water-fleet?utm_source=marketo&utm_medium=email&utm_campaign=newsletter&utm_content=newsletter&mkt_tok=NzU2LUZXSi0w.

[27] “SPRFMO Record of Vessels.” South Pacific Regional Fishing Management Organisation. Accessed May 15, 2025. https://sprfmo.org/vessels; S&P Global Maritime Intelligence Risk Suite