The C4ADS Dubai Property Database (2022)

In 2022, C4ADS partnered with a coalition of journalists and scholars in 19 countries across the world to enable their independent investigations into the vast illicit wealth held in Dubai’s property market.

Our Coalition In 2022 #

In 2022, we collaborated with a coalition of scholars and journalists from around the world to shed light on the vast illicit wealth held in Dubai’s property market.

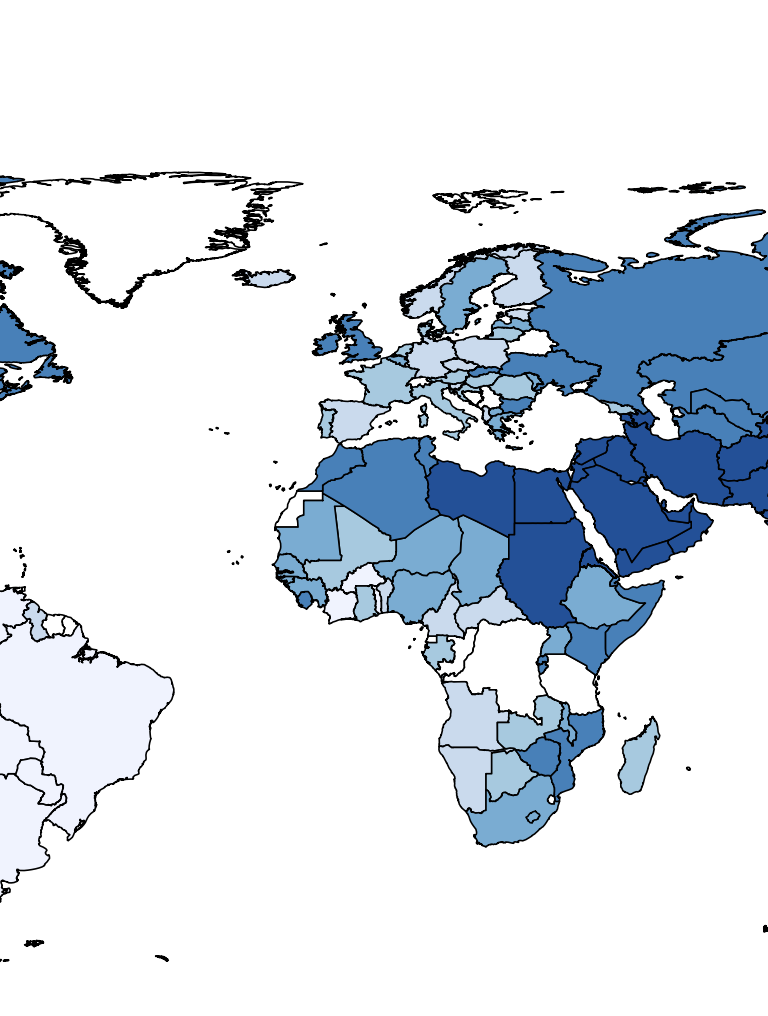

- C4ADS has worked with a team of the world’s leading experts in tax justice at the University of California, Berkeley and the Norwegian University of Life Sciences (NMBU) to support a groundbreaking paper on Dubai’s role in global patterns of tax avoidance. The paper presents a comprehensive analysis of property ownership in Dubai to estimate the value of aggregate real estate owned by nationality group, and to analyze country-level patterns. Their findings provide new understanding of hidden wealth in one of the world’s largest offshore financial centers.

- C4ADS also provided data from our Dubai property database to a consortium of 25 journalists in 19 countries to enable their independent investigations. These examinations have exposed and revealed the overseas holdings of public officials, alleged perpetrators of international crime, sanctions evaders, and more.

Interested in collaborating with us on a project where our data may be useful? Email [email protected].

Publications We Supported in 2022 #

Who Owns Offshore Real Estate? Evidence From Dubai

A. Alstadsæter, G. Zucman, B. Planterose, and A. Økland | May 3, 2022

C4ADS has worked with a team of the world’s leading experts in tax justice at the University of California, Berkeley and the Norwegian University of Life Sciences (NMBU) to support a groundbreaking paper on Dubai’s role in global patterns of tax avoidance. The paper presents a comprehensive analysis of property ownership in Dubai to estimate the value of aggregate real estate owned by nationality group, and to analyze country-level patterns. Their findings provide new understanding of hidden wealth in one of the world’s largest offshore financial centers.

The takeaways? To clean up its domestic property market, the United Arab Emirates must improve its due diligence standards, transparency, and enforcement. More robust screening for sanctioned individuals and politically exposed persons should be combined with risk-based approaches that go beyond sanctions list. More proactive efforts by law enforcement to stop the inflows of illicit wealth can prevent future property acquisitions by corrupt officials, arms traffickers, money launderers, and other bad actors — thereby improving the UAE’s international legal and financial standing.

Investigating International Crime and Corruption in the Dubai Property Market

C4ADS also provided data from our Dubai property database to a consortium of 25 journalists in 19 countries to enable their independent investigations. These examinations have exposed and revealed the overseas holdings of public officials, alleged perpetrators of international crime, sanctions evaders, and more. See below for a list of news articles we have supported.

Drugs, Fraud and Weapons in Norway: Here are the Properties in Dubai – Eiliv Frich Flydal, Jonas Alsaker Vikan, and Fredrick Chr. Ekeseth (October 22, 2022)

Dubai Uncovered – Eiliv Frich Flydal, Matthew Kupfer, Jonas Alsaker Vikan, and Fredrick Chr. Ekeseth (May 3, 2022)

Dubai Uncovered: Data Leak Exposes How Criminals, Officials, and Sanctioned Politicians Poured Money Into Dubai Real Estate – Matthew Kupfer and Eiliv Frich Flydal (May 3, 2022)

Datalek ontmaskert 191.000 buitenlandse eigenaars van vastgoed in Dubai – Lars Bové (May 3, 2022)

Dubai Uncovered: datalek onthult 191.000 buitenlandse vastgoedeigenaars in Dubai – Kristof Clerix (May 3, 2022)

Report: 68 Bosnians own 105 properties worth a total of $ 27 million in Dubai – N1 Sarajevo (May 3, 2022)

Svindeldømt dansker med skattegæld ejer dyre ejendomme i Dubai, og myndighederne kan ikke røre dem – Allan Spangsberg Hansen, Tore Bønke, Eiliv Frisch Flydal, and Matthew Kupfer (May 3, 2022)

« Dubai Uncovered » : révélations sur l’immobilier de l’émirat, destination providentielle pour l’argent sale des oligarques et des criminels – Jérémie Baruch, Anne Michel, and Vincent Nouvet (May 3, 2022)

Putin-Vertraute sollen Vermögen in Dubai geparkt haben (May 3, 2022)

Russen bringen ihr Geld in Dubai in Sicherheit (May 3, 2022)

Spielplatz der Ganoven – Jan Diesteldorf and Meike Schreiber (May 3, 2022)

Reiche Russen sichern Vermögen offenbar in Dubai (May 3, 2022)

Ukraine-News: Dubai als sanktionsfreie Luxus-Oase für Russlands Superreiche – Patricia Huber (May 3, 2022)

INSIDE THE MOB: Leaked papers show Daniel Kinahan bought stunning Dubai office in Jumeirah Bay Tower – Neil Fetherstonhaugh (May 3, 2022)

Dubai svelata – Cecilia Anesi, Raffaele Angius, Edoardo Anziano, Francesca Cicculli, Carlotta Indiano, and Fabio Papetti (May 3, 2022)

DESTINAȚIA DUBAI – Ana Poenariu, Bianca Albu, Florin Râșteiu (May 3, 2022)

Новорусские в Дубае – РОМАН АНИН, АЛЕСЯ МАРОХОВСКАЯ, ИРИНА ДОЛИНИНА (May 3, 2022)

Oligarchen retten ihr Vermögen mit Dubai-Trick – Liebe Leserin, lieber Leser (May 3, 2022)

Кремлевская элита скупает недвижимость в Дубае: среди владельцев – друзья Кадырова и “экс-премьер ДНР” – Kseniya Kapustinskaya (May 3, 2022)

Dirty money from Russia and Europe flooding Dubai real estate, researchers say – Borzou Daraghi (May 4, 2022)

Inside The Offshore Empire Helmed By Gautam Adani’s Older Brother — John Hyatt and Giacomo Tognini (February 17, 2023)

Exclusive: New Investigation Reveals Gautam Adani’s Older Brother As Key Player In Adani Group’s Biggest Deals — Giacomo Tognini and John Hyatt (February 28, 2023)

Other Work We’ve Supported #

How a Playground for the Rich Could Undermine Sanctions On Oligarchs (March 9, 2022)

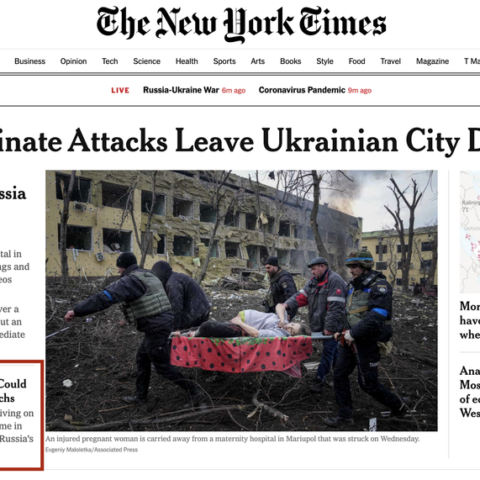

In the aftermath of Russia’s 2022 invasion of Ukraine, Russian political elites have sought to protect their assets from sanction and confiscation in jurisdictions like Dubai, the Maldives, and the Seychelles.

The New York Times used C4ADS’ Dubai property data to shed light on Russian and Belarusian assets in Dubai. We identified 76 properties held by these individuals in Dubai: Russian oligarchs, sanctioned members of the Duma, and allies of Putin and Lukashenka hold more than $314 million of properties in the Emirate.

How a Playground for the Rich Could Undermine Sanctions On Oligarchs

Dubai’s Role in Facilitating Corruption & Global Illicit Financial Flows (July 7, 2020)

In Dubai, weak regulation, poor enforcement, and relatively high levels of secrecy and anonymity create a welcoming environment for global kleptocrats, money launderers, and other illicit entrepreneurs seeking to hide ill-gotten earnings.

C4ADS contributed to this Carnegie Endowment report, Dubai’s Role in Facilitating Corruption and Global Illicit Financial Flows.

Dubai Property: An Oasis For Nigeria’s Corrupt Political Elites (March 19, 2020)

For Nigeria’s corrupt political elites, Dubai is the perfect place to stash their ill-gotten gains and enjoy luxury real estate worth millions. But unless authorities stop turning a blind eye, the long-term costs to Nigeria’s economy and Dubai’s reputation could be high.

C4ADS contributed to this Carnegie Endowment report, Dubai Property: An Oasis for Nigeria’s Corrupt Political Elites.

Sandcastles: Tracing Sanctions Evasion Through Dubai’s Luxury Real Estate Market (June 12, 2018)

In this 2018 report, we examine seven individuals and organizations, their associated corporate networks, and their real estate holdings. We identify 44 properties worth approximately $28.2 million directly associated with sanctioned individuals, as well as 37 properties worth approximately $78.8 million within their expanded networks. Each of these people has been sanctioned by the United States (US), and many have also been designated by the European Union (EU) and EU members states. These networks are, therefore, deserving of particularly intense regulatory scrutiny. However, our research reveals that they have invested million of dollars in luxury UAE real estate while continuing to engage in illicit activity with the last few years.

Disclaimer #

C4ADS assesses this data to be credible, with the caveat that it does not constitute evidence of the same quality and standard as a property deed, a form of official documentation strictly controlled in the UAE as confidential information. The mention of any individual, company, organization, or entity in this dataset does not imply the violation of any law or international agreement.