Sandcastles

In this report, we ultimately identify 44 properties in the Dubai luxury real estate market worth approximately $28.2 million directly associated with sanctioned individuals, as well as 37 properties worth approximately $78.8 million within their expanded networks.

Executive Summary #

Illicit actors, whether narcotics traffickers, nuclear proliferators, conflict financiers, kleptocrats, large-scale money launderers, or terrorists, all share a common need: they must move the proceeds of their criminal endeavors from the illicit marketplace into the licit financial system in order to use them effectively. Luxury real estate has become a significant pathway for this conversion, facilitated by imperfect information regarding ownership and the details behind these substantial financial transactions. This vulnerability affects major real estate markets around the world, including, but not limited to: London, Toronto, Hong Kong, New York, Singapore, Doha, Sydney, and Paris.

Dubai, the largest city in the United Arab Emirates (UAE), has become a favorable destination for these funds due in part to its high-end luxury real estate market and lax regulatory environment prizing secrecy and anonymity. While the UAE has taken steps to address this issue, its response thus far has failed to fully confront the underlying drivers enabling the manipulation of its real estate market. The permissive nature of this environment has global security implications far beyond the UAE. In an interconnected global economy with low barriers impeding the movement of funds, a single point of weakness in the regulatory system can empower a range of illicit actors. Our research shows that lax regulatory and enforcement environments –in Dubai, but also in other financial centers – have attracted criminal capital from around the world and offered a pathway into the international financial system for illicit actors and funds.

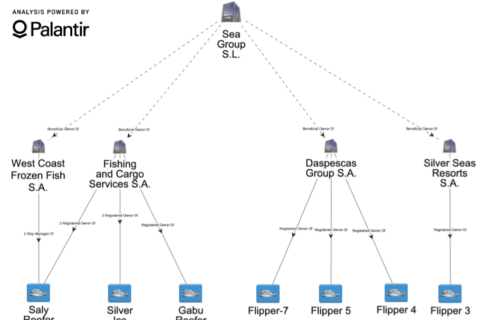

In this report, we examine seven individuals and organizations, their associated corporate networks, and their real estate holdings. We identify 44 properties worth approximately $28.2 million directly associated with sanctioned individuals, as well as 37 properties worth approximately $78.8 million within their expanded networks. Each of these people has been sanctioned by the United States (US), and many have also been designated by the European Union (EU) and EU member states. These networks are, therefore, deserving of particularly intense regulatory scrutiny. However, our research reveals that they have invested millions of dollars in luxury UAE real estate while continuing to engage in illicit activity within the last few years. These individuals and organizations, including their primary illicit activity and country of origin, are:

In nearly every case, we find:

- Properties associated with these individuals are directly connected to information within their sanctions designations. We identify a total of 44 properties associated with the primary sanctioned subjects across the seven profiles, of which 42 were previously unidentified.

- Expansive unsanctioned corporate networks, often with direct ties to the individual’s Dubai properties. These networks extend to jurisdictions as wide ranging as Syria, Romania, Mexico, Cyprus, Lebanon, Hong Kong, the United States, Liberia, and the British Virgin Islands, to name but a few.

- Extensive use of family and third-party networks like lawyers, business partners, and nominees to obscure beneficial ownership of both sanctioned and unsanctioned commercial entities.

- Ongoing activities for which the individuals and networks were originally sanctioned, activities that are, in some cases, more prolific than they were prior to the sanctions.