War Machine

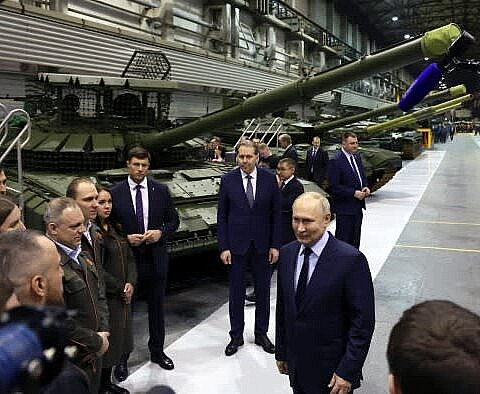

In the face of global sanctions and other trade restrictions, Russia continues to import technology from countries that publicly support Kyiv — specifically, computer numeric control (CNC) machine tools that automate the manufacturing of defense equipment critical to Moscow’s ability to wage war on Ukraine.

Executive Summary #

Degrading Russia’s ability to wage war is critical to the survival of Ukrainian democracy. Among the Russian defense industry’s greatest vulnerabilities is its reliance on foreign technologies. Few technologies embody this vulnerability better than computer numeric control (CNC) machine tools — devices that employ computer technology to automate the manufacture of critical defense equipment like precision-guided munitions and aircraft parts.

The Russian defense industry has historically sourced foreign-produced CNC machine tools (FPCMTs) from jurisdictions whose

governments now support Kyiv, either vocally or through the enforcement of trade restrictions against Russia like sanctions and export controls. This made it possible on paper for Ukraine’s allies to limit Russia’s access to new FPCMTs, and essential components thereof. Yet public reporting suggests that the Russian arms machine remains at full throttle, inviting questions about the efficacy and enforcement of those restrictions practice.

Despite voicing support for Ukraine and agreeing in principle to crack down on Russia, some jurisdictions have dragged their feet to the point of becoming key points of failure in enforcement regimes. Weakening Russia’s ability to wage war against Ukraine — and potentially other neighbors — requires accounting for Russia’s complex procurement tactics, and closing the enforcement-regime gaps that enable them.

To this end, C4ADS investigated shifts in Russia-oriented FPCMT supply chains after Russia’s reinvasion of Ukraine on February 24, 2022. Key findings include:

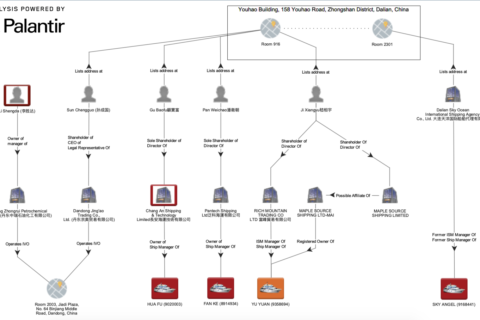

- Despite actions or statements made in support of Ukraine, intermediaries based in “third countries” (jurisdictions that

facilitate shipments of goods but are neither the origin nor the destination of those goods) undermine export controls and sanctions. Companies and individuals in these jurisdictions act as brokers, supplying FPCMTs not only to Russian defense industry contractors but also to Russian subsidiaries of foreign machine tool firms that allegedly exited Russia after February 2022. Third-country brokers are uniquely positioned to exploit supply chain vulnerabilities by supplying Russian customers with previously used FPCMTs from resellers abroad. Key “broker” countries of concern are China and Hong Kong, Turkey, and United Arab Emirates. - Russia appears to practice two key evasion tactics: “subsidiary-oriented evasion,” where Russian subsidiaries of foreign machine tool firms access products made by their parent companies after the latter had allegedly exited the Russian market, and “distributor-oriented evasion,” where Russian machine tool distributors not owned by foreign machine tool manufacturers import FPCMTs and parts, both new and used.

- Five case studies illustrate these trends. Ten of the companies discussed therein have been sanctioned, the most recent on June 12, 2024, while six remain unsanctioned as of the date of publication. These sums pertain only to the companies involved in procuring FPCMTs and not their likely end-users. Safeguarding regional security requires policies that frustrate efforts to procure FPCMTs and other dual-use technologies that sustain the Russian defense industry. For these policies to be effective, increased enforcement resources, stiff penalties for noncompliance, and more coordinated crossjurisdictional collaboration must work in concert. Accordingly, based on our findings, we make a series of public-policy and privatesector recommendations to better curb the trade emanating from third-country brokers.

Correction (As of November 18, 2024): The PDF version of this report printed on June 18, 2024 erroneously identified Turkish company Modulsan as part of the Aydin Corporate Network. Modulsan has made shipments to Guhring RU in the past, but operates independently of the Aydin network.

In the News #